Stablecoin Regulation in Singapore: A Complete FAQ Guide

How does Singapore legally define, categorise, and regulate stablecoins under its regulatory framework?

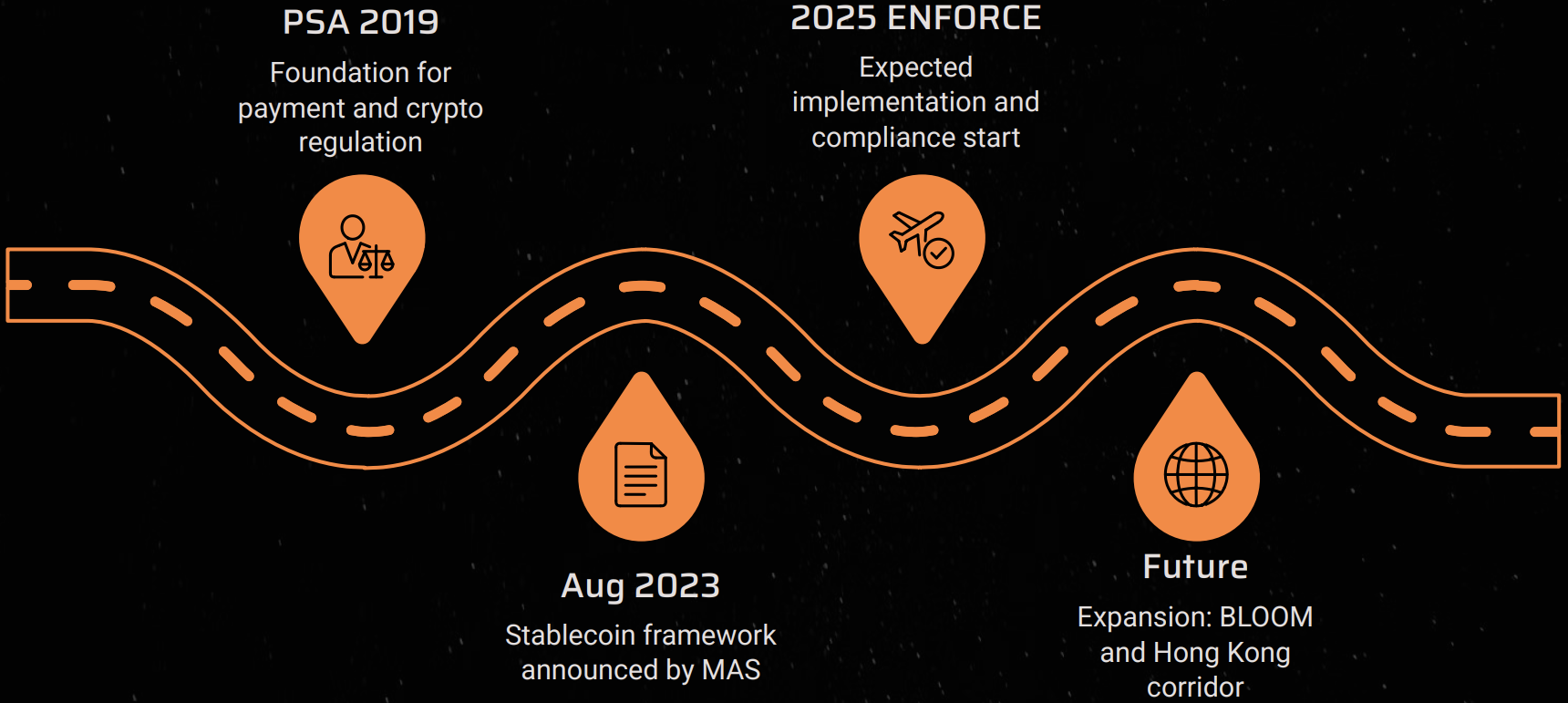

Under Singapore’s regulatory framework, the Monetary Authority of Singapore (MAS) defines and classifies stablecoins through a layered structure primarily under the Payment Services Act 2019 (PSA), complemented by the Stablecoin Regulatory Framework finalised on August 15, 2023.

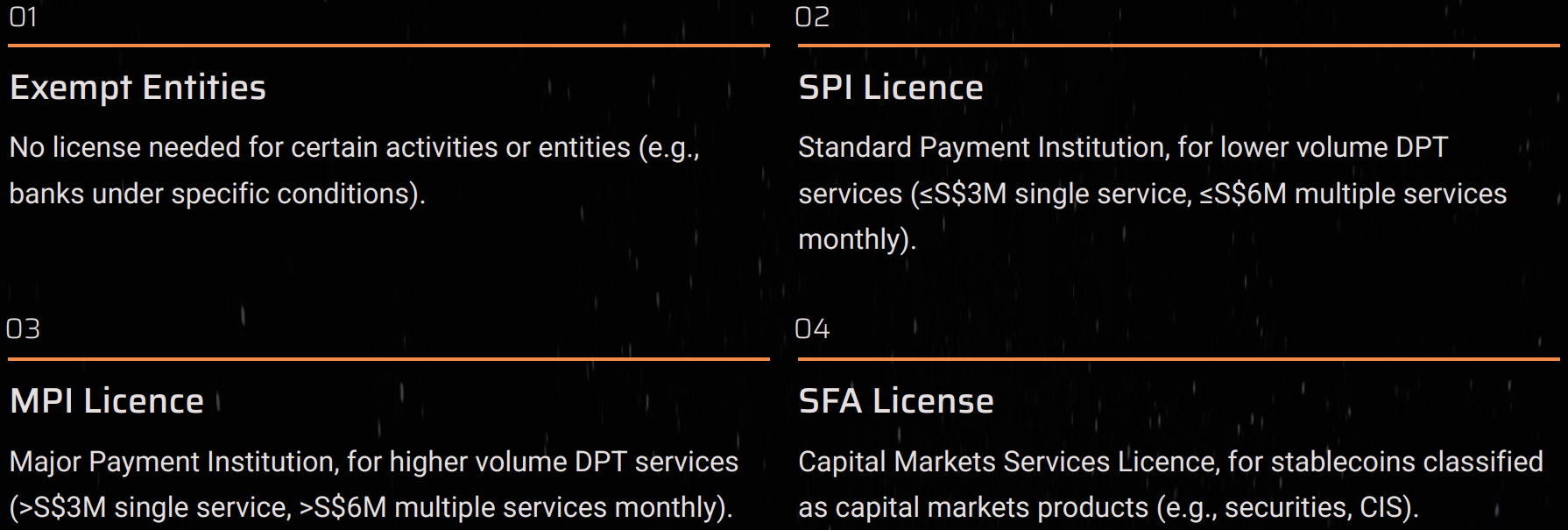

In general, stablecoins fall under the category of Digital Payment Tokens (DPTs) as per the PSA. A DPT refers to any digital representation of value that can be transferred, stored, or traded electronically and is commonly used as a medium of exchange. Entities dealing in DPT-related services, such as issuing, exchanging, or managing stablecoins, must obtain a Major Payment Institution (MPI) or Standard Payment Institution (SPI) license. The PSA focuses on compliance with anti-money laundering (AML), counter-terrorism financing (CFT) obligations, and technology risk management. Fiat-referenced stablecoins are therefore primarily regulated for their function as a payment medium.

MAS introduced a heightened category known as Single-Currency Stablecoins (SCS) under its 2023 framework. These stablecoins are subject to enhanced prudential, reserve, and redemption requirements if they meet specific criteria. The framework distinguishes between general DPTs and MAS-regulated stablecoins, as shown below:

| Category | Definition and Criteria | Regulatory Status |

| SCS | Stablecoins pegged to a single fiat currency. | Subject to the general DPT regime unless they meet the specific requirements. |

| MAS-Regulated Stablecoins | SCS pegged only to the Singapore Dollar (SGD) or any G10 currency. | Issuers must meet strict requirements on reserve backing, segregation, redemption at par, and capital adequacy. Only compliant issuers can use the term “MAS-regulated stablecoin.” |

Issuers of MAS-regulated SCS engage in a regulated activity known as the “Stablecoin Issuance Service” under the PSA. Those whose total issuance exceeds S$5 million are generally required to hold an MPI license. Stablecoins that do not qualify as MAS-regulated SCS remain under the standard DPT regime. These include:

- Multi-currency stablecoins pegged to multiple fiat currencies;

- Non-G10 fiat-referenced stablecoins;

- Algorithmic stablecoins, which rely on supply-adjusting algorithms and are considered more volatile; and

- Asset-referenced stablecoins, backed by non-fiat assets such as gold or commodities.

Certain stablecoins may also fall under other legal categories. For instance, if a stablecoin’s structure gives it characteristics of an investment product, it could be subject to the Securities and Futures Act (SFA), which governs securities, collective investment schemes (CIS), and derivatives. In such cases, related activities would require SFA licensing. Stablecoins generally do not qualify as e-money under the PSA, as they are not “pegged” by the issuer in the same way and often lack a direct claim against the issuer.

What is the legislative and regulatory framework governing stablecoins in Singapore?

1. Payment Services Act 2019 (PSA)

The PSA is the primary legislation governing payment services, including stablecoins treated as DPTs. A DPT is defined as any digital representation of value that can be transferred, stored, or traded electronically and is commonly used as a medium of exchange. Entities involved in issuance, buying, selling, exchange, or custody of stablecoins are required to obtain a Standard Payment Institution or Major Payment Institution licence.

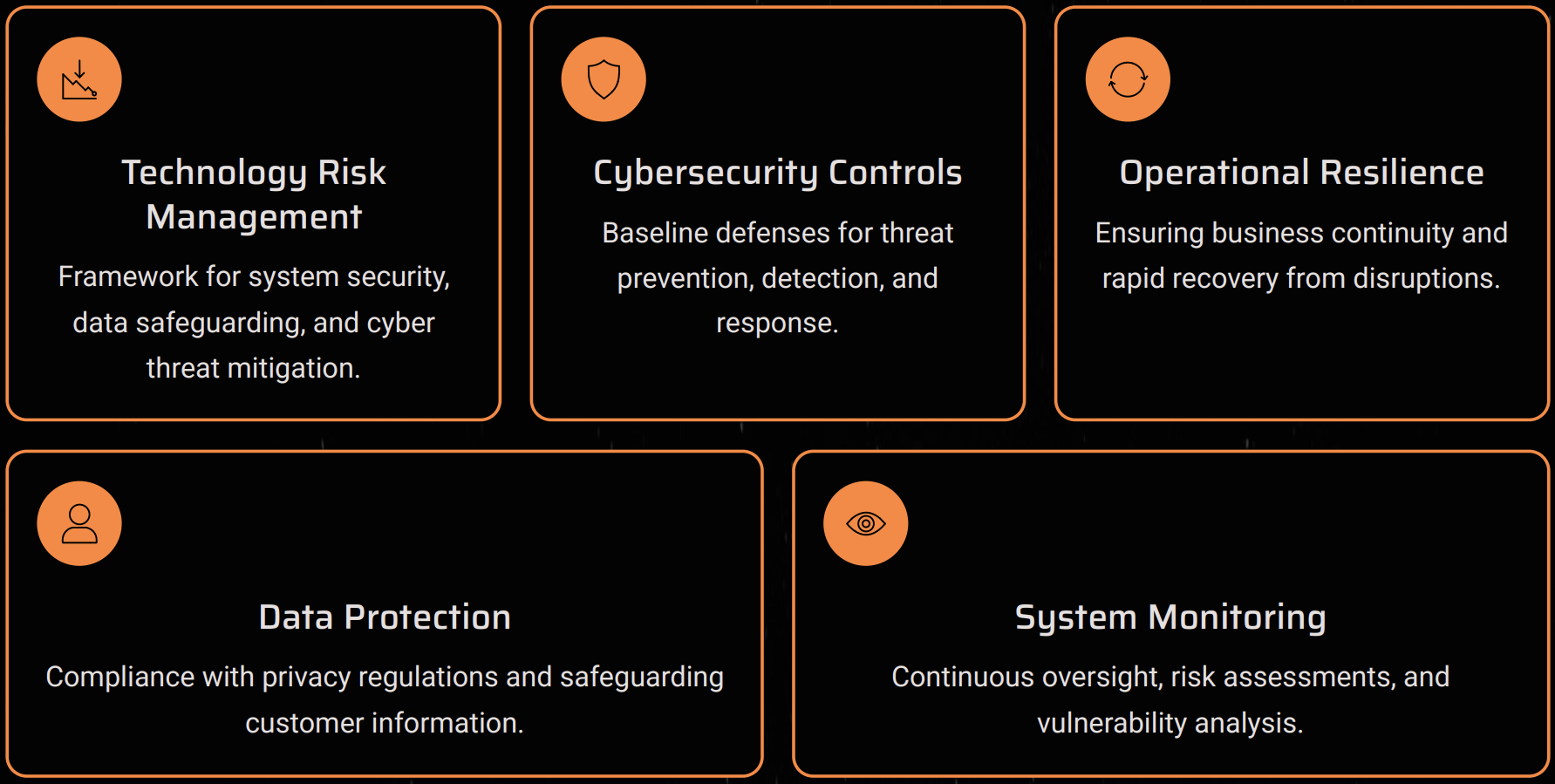

The PSA focuses on AML/CFT compliance, technology risk, and operational risk controls. DPT service providers must comply with MAS Notices PSN02, PSN07, and PSN08 relating to AML/CFT, conduct, and disclosure obligations. The PSA also regulates custodial wallet and safeguarding of customer DPT assets, and amendments to the Payment Services Regulations impose user protection requirements relating to the safeguarding of customer assets.

The PSA provides MAS authority to license, supervise, and enforce compliance. It also includes a designation regime under Part 3, allowing MAS to designate payment systems, including systemic stablecoin arrangements, where necessary for monetary or financial stability.

2. Amendments to the PSA (2021–2025)

Amendments introduced from 2021 through 2025 refine the PSA to address the stablecoin market more directly. These amendments introduced recognition of “MAS-Regulated Stablecoins”, expanded regulatory definitions to capture Stablecoin Issuance Services, and imposed additional prudential, operational, and disclosure requirements on qualifying stablecoin issuers.

3. Stablecoin Regulatory Framework (MAS, August 2023)

This framework applies to SCS pegged to the Singapore Dollar or any G10 currency. It introduces the regulated activity of Stablecoin Issuance Service, covering issuance/redemption of SCS, custody of issued SCS, and management of the reserve assets backing the SCS. Issuers must hold a MPI licence if total issuance exceeds S$5 million. Only those meeting all requirements may use the term “MAS-regulated stablecoin.” Misrepresentation of this label may result in penalties.

Key Requirements for MAS-Regulated Stablecoin Issuers:

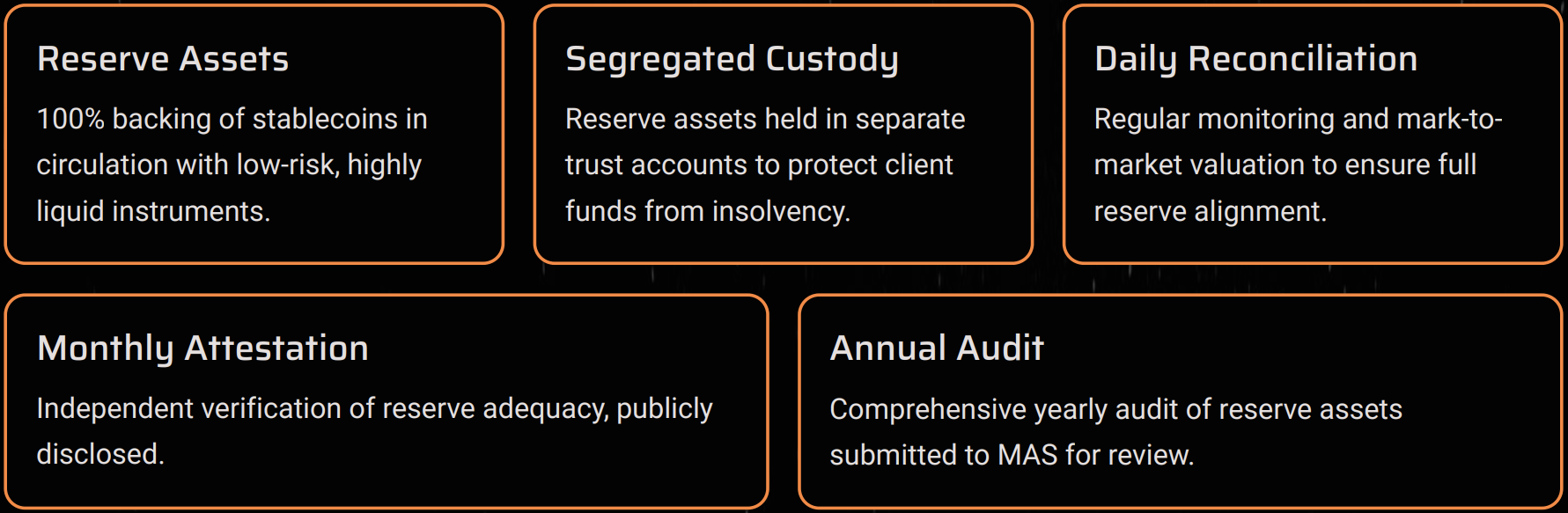

- Reserve Assets: Must equal at least 100% of par value and be held in cash, cash equivalents, or high-quality short-term debt securities (≤3 months maturity) issued by sovereigns/central banks of the pegged currency or entities rated AA- or above.

- Reserve Custody and Segregation: Reserves must be segregated and held with permitted custodians, including MAS-regulated institutions or foreign custodians rated A- or above.

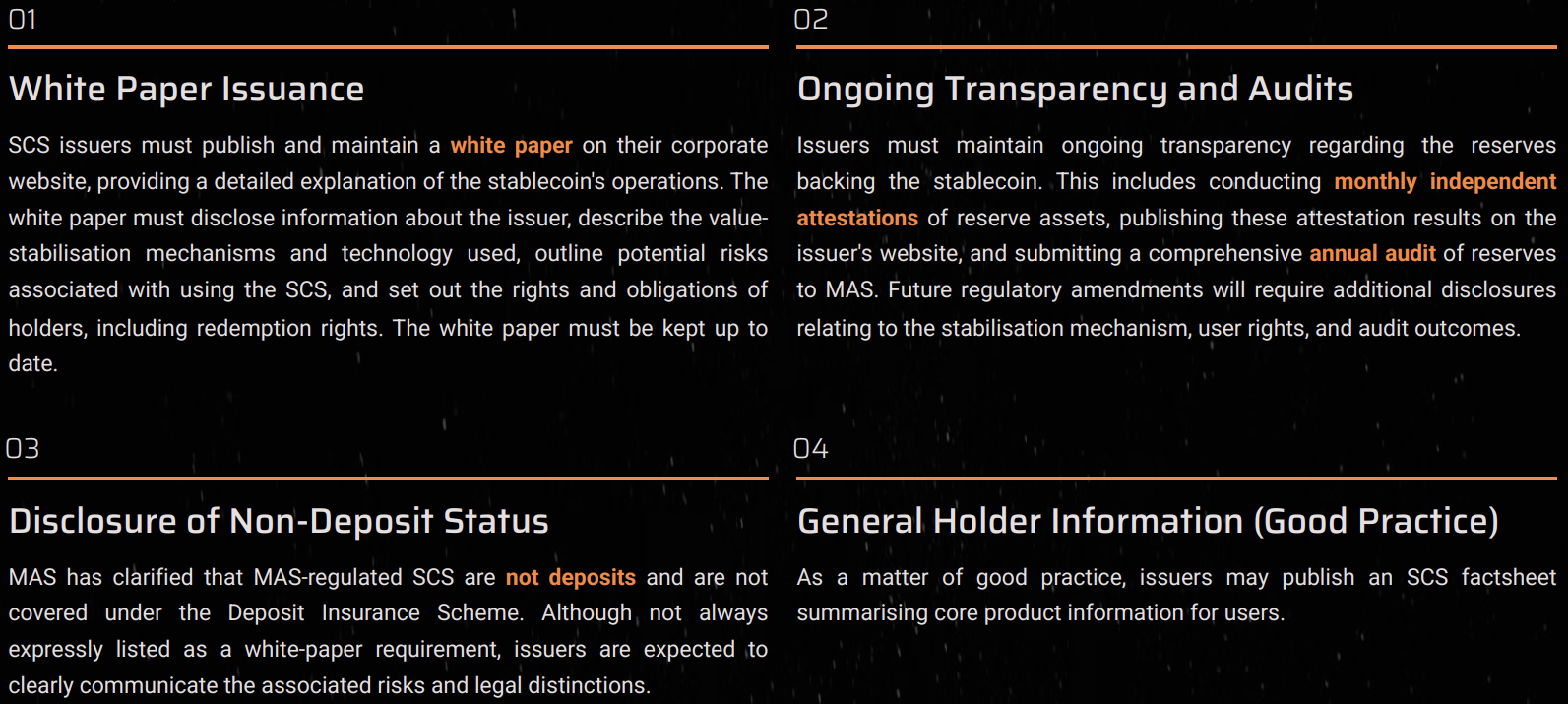

- Monitoring and Audit: Daily reserve valuation; monthly independent attestations published; annual audit submitted to MAS.

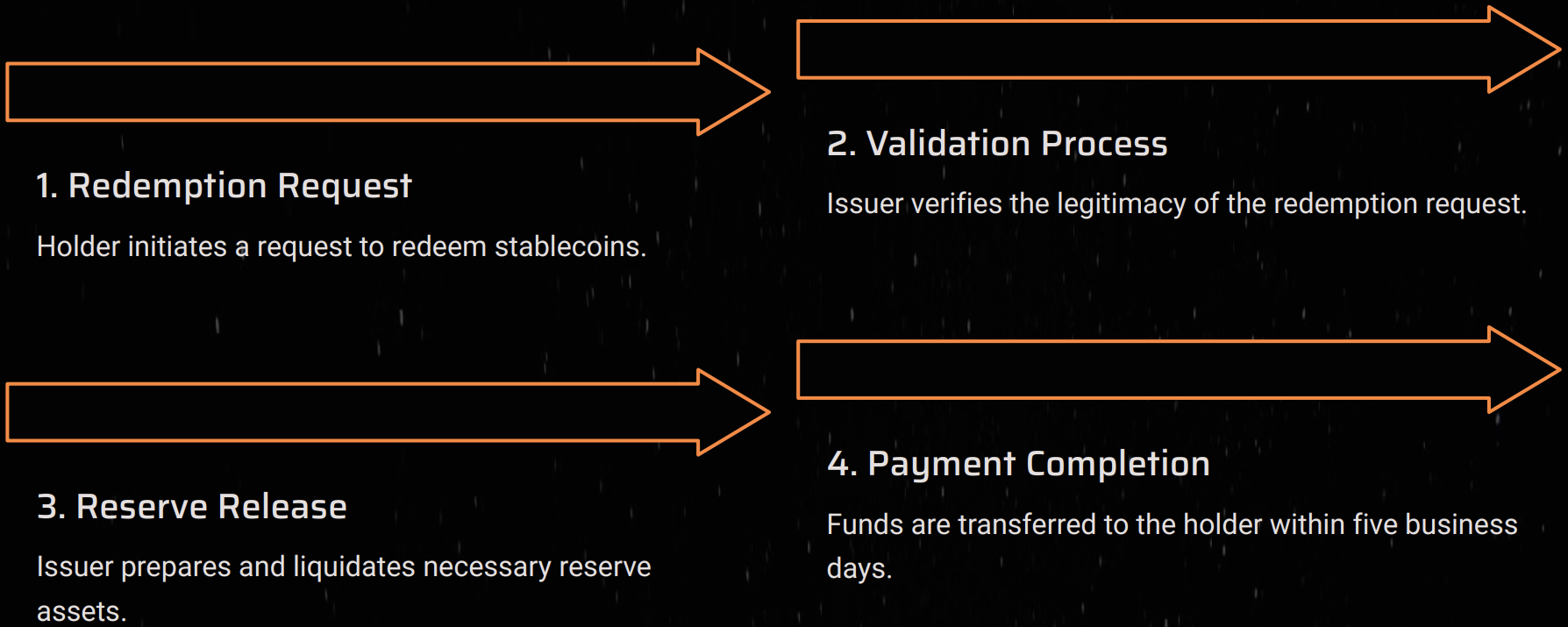

- Redemption: Stablecoins must be redeemable at par (1:1) within five business days of a valid request.

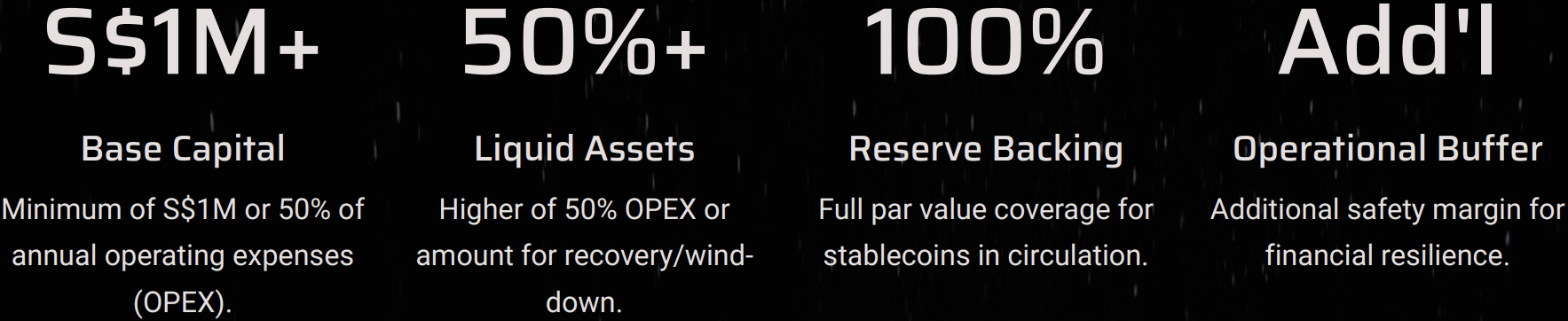

- Capital Requirements: Issuers must maintain capital of the higher of S$1 million or 50% of annual operating expenses, and hold liquid assets equal to the higher of 50% of annual OPEX or the assessed recovery/wind-down amount.

- Business Restrictions: SCS issuers may not provide non-issuance services such as lending or staking and may not hold ownership interests in other entities.

- Disclosure: Issuers must publish a white paper detailing issuer information, stabilisation mechanism, redemption rights, obligations, and risks.

- Governance and Risk Management: Issuers must maintain structured governance, operational resilience measures, and ongoing compliance monitoring.

4. Securities and Futures Act (SFA)

The SFA applies where a stablecoin displays features of capital markets products, such as securities, derivatives, or units in a CIS. If applicable, activities such as issuance, dealing, advisory services, or market operation require SFA licensing, and market conduct rules apply, including MAS-proposed measures regarding unfair or manipulative trading practices relevant to DPT service providers.

5. AML/CFT Regulatory Requirements

Stablecoin issuers and intermediaries must comply with MAS AML/CFT Notices, including PSN02, in alignment with FATF standards. Requirements include customer due diligence, travel rule compliance, transaction monitoring, and suspicious transaction reporting and restrictions on dealing with sanctioned entities.

6. Supporting Guidelines and Policy Updates

MAS issues governance, risk management, cybersecurity, marketing, and audit guidelines applicable to stablecoin-related service providers. The Cybersecurity Act 2018 applies where Critical Information Infrastructure is involved. The PDPA (2012) applies to personal data handling. MAS has conducted multiple public consultations outlining transitional arrangements and ongoing adjustments to the stablecoin regime.

Which regulatory authorities oversee stablecoin-related activities in Singapore, and what is their respective scope?

The regulation and oversight of stablecoin-related activities in Singapore are primarily centralised under the MAS, which exercises authority through multiple legislative frameworks. Other authorities play a supporting role, particularly concerning taxation and specific legal enforcement.

1. Monetary Authority of Singapore (MAS)

MAS is the central bank and the primary integrated regulator of the financial sector in Singapore. MAS is the authoritative body responsible for enforcing regulations governing fiat-referenced stablecoins.

Under the PSA, MAS regulates stablecoins broadly as DPTs. MAS supervises and licenses entities providing DPT services, including the issuance, buying, selling, exchanging, transfer, or provision of custodian wallets for DPTs. Issuers and intermediaries must obtain a SPI License or a MPI License. MAS applies and enforces AML and CFT controls on DPT service providers, including requirements for customer due diligence, transaction monitoring, and suspicious transaction reporting. Under the payment system designation provisions in Part 3 of the PSA, MAS may designate systemic stablecoin arrangements as Designated Payment Systems (DPSs) and impose heightened operational and financial requirements where disruption could cause instability or affect public confidence.

MAS also carries out oversight under the Stablecoin Regulatory Framework, finalised on August 15, 2023. This framework introduces specific and heightened regulation for SCS pegged to the Singapore Dollar (SGD) or G10 currencies. The activity of issuing these SCS is regulated as “Stablecoin Issuance Service” under the PSA and covers the minting and burning of SCS, and the custody and management of the reserve assets backing the SCS. MAS supervises compliance with prudential requirements, including maintaining 100% reserve backing in highly liquid, low-risk assets, daily mark-to-market valuation of reserves, monthly independent attestations and annual audits submitted to MAS, and minimum capital requirements (S$1 million or 50% of annual operating expenses, whichever is higher). MAS also ensures consumer protection by requiring issuers to provide a direct legal claim for redemption at par value (1:1) and to complete redemption requests within five business days. A white paper must be published disclosing operational details, risks, and the rights of SCS holders.

MAS additionally enforces the SFA where stablecoins exhibit characteristics of capital markets products. If a stablecoin functions similarly to securities, units in a collective investment scheme, or derivatives contracts, related activities such as dealing, advising, or operating an exchange fall under SFA regulation. Entities establishing or operating organised markets for such stablecoins require MAS approval either as an Approved Exchange or a Recognised Market Operator.

2. Other Authorities

While MAS is the primary regulator, other authorities have jurisdiction over specific legal and compliance aspects. The Inland Revenue Authority of Singapore (IRAS) may oversee taxation implications related to digital assets. Law enforcement authorities such as the Singapore Police Force, the Commercial Affairs Department (CAD), and the Corrupt Practices Investigation Bureau may intervene where legal violations occur. All persons must comply with suspicious transaction reporting obligations to the Suspicious Transaction Reporting Office (STRO), CAD, under Section 39 of the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA). Compliance with the Terrorism (Suppression of Financing) Act (TSOFA) is also required, which prohibits dealing with designated individuals and entities. Oversight related to personal data handling falls under the Personal Data Protection Commission (PDPC) under the Personal Data Protection Act 2012 (PDPA), which governs the collection, use, and disclosure of personal data.

What is the territorial and extraterritorial application of Singapore’s stablecoin regulations?

The application of Singapore’s stablecoin regulations is defined by a strict territorial focus for the highest regulatory tier under the Stablecoin Regulatory Framework, alongside a broader extraterritorial reach under foundational legislation relating to digital payment tokens and capital markets oversight. The territorial scope depends on whether the stablecoin falls under the PSA as a DPT or under the SFA as a capital markets product, as well as whether the stablecoin is issued under the framework for SCS administered by the MAS.

I. Strict Territorial Application (MAS-Regulated Stablecoins)

The Stablecoin Regulatory Framework, finalised on August 15, 2023, applies strictly to SCS that are pegged to the Singapore Dollar (SGD) or any G10 currency and are issued in Singapore. For a stablecoin to be legally recognised and labelled as an “MAS-regulated stablecoin,” MAS requires that the stablecoin be issued solely out of Singapore and not issued from multiple jurisdictions. This territorial restriction is imposed because MAS has identified challenges in establishing regulatory equivalence across jurisdictions and ensuring effective reserve management oversight when reserves or issuance operations are located abroad. Additionally, once tokens circulate and commingle across jurisdictions, it becomes difficult to trace the original issuance provenance, making monitoring and redemption assurance more complex. MAS may revisit and adjust this position as global regulatory coordination on stablecoins develops.

II. Application to Intermediaries and Foreign Stablecoins

Although the issuance of MAS-regulated SCS is territorially confined, other stablecoins and intermediaries conducting stablecoin-related activities in Singapore fall under broader regulatory provisions within the PSA.

Non-MAS-regulated stablecoins, including SCS issued outside Singapore, multi-currency stablecoins, or stablecoins pegged to non-G10 currencies, are not prohibited from being issued, circulated, or used in Singapore. These stablecoins are regulated under the general DPT regime in the PSA.

Any foreign or domestic entity providing DPT services relating to stablecoins in Singapore must be licensed under the PSA. A license applicant (other than for money-changing) may be incorporated outside Singapore, but must maintain a permanent place of business or registered office in Singapore, and must have at least one executive director who is a Singapore citizen or permanent resident.

MAS also intends to extend the PSA’s scope extraterritorially in line with enhanced Financial Action Task Force (FATF) standards. This includes imposing AML and CFT requirements on entities incorporated in Singapore that conduct virtual asset or DPT services outside Singapore.

III. Extraterritorial Application under the SFA

Where a stablecoin qualifies as a capital markets product, such as a security, derivative, or unit in a collective investment scheme, the SFA applies, including its extraterritorial provisions.

Under SFA Section 339, the SFA may apply even where activities occur partly in Singapore and partly outside Singapore, or wholly outside Singapore. The general compliance obligation under SFA Part 137ZI applies to all natural persons and all entities, regardless of citizenship, residency, jurisdiction of incorporation, or business location, and extends to conduct and omissions occurring outside Singapore. The SFA also recognises that a foreign entity may be considered a regulated financial institution if it carries out activities that, if conducted in Singapore, would require approval, licensing, registration, or regulatory authorisation by MAS.

Under what circumstances can a stablecoin be treated as a security or investment product?

The primary regulatory approach in Singapore is to classify fiat-referenced stablecoins as DPTs under the PSA, viewing them as a medium of exchange. Fiat-referenced stablecoins are generally not treated as securities or investment products. However, a stablecoin can be treated as a security or an investment product if its structure and the rights conferred upon its holders cause it to fall under the definitions of Capital Markets Products governed by SFA. The MAS determines this classification by examining the structure and characteristics of the digital token, as well as the rights attached to it, looking beyond labels or terminology. A stablecoin will be treated as a security or investment product under the SFA or the Financial Advisers Act (FAA) if it exhibits characteristics akin to any of the Capital Markets Products described below.

1. Securities

A stablecoin may be classified as a security if it possesses characteristics of shares, debentures, or units in a business trust. A digital token constitutes a share where it confers or represents ownership interest in a corporation. A digital token constitutes a debenture where it evidences the indebtedness of the issuer in respect of any money that is, or may be, lent to the issuer by a token holder. This applies where the issuer is under an obligation to buy back the stablecoin from holders, and the token represents the issuer’s indebtedness to repay the holder.

2. Units in a Collective Investment Scheme (CIS)

A stablecoin may be treated as a unit in a CIS if the underlying arrangement enables holders to participate in or receive profits, income, or other returns arising from the acquisition, holding, management, or disposal of property. If the stablecoin model includes mechanisms designed to generate returns (e.g., lending or staking services), then the stablecoin functions as a CIS unit and becomes subject to SFA regulation. The MAS-regulated stablecoin framework finalised in August 2023 expressly prohibits lending or staking of stablecoins or other DPTs within the issuing entity to prevent this outcome.

3. Derivatives Contracts

A stablecoin may be treated as a derivatives contract where its value is determined by reference to an underlying asset, instrument, commodity, or index. A securities-based derivatives contract arises where the referenced underlying is a security or securities index, such as shares, debentures, or business trust units.

Consequences of SFA Classification

If a stablecoin is classified as a Capital Markets Product under the SFA, the issuer and intermediaries must comply with the relevant capital markets regulatory requirements, regardless of its original classification as a DPT.

| Activity | Regulatory Requirement (SFA Reference) |

| Offer or Issue | The offer must comply with Part XIII of the SFA, which may require preparation and registration of a prospectus with MAS, unless an exemption applies. |

| Dealing / Facilitating Exchange | Entities dealing in or facilitating exchange must hold a Capital Markets Services (CMS) licence for dealing in capital markets products. |

| Operating a Trading Platform | A platform operator may be considered to be operating an organised market and must be approved as an Approved Exchange or Recognised Market Operator under the SFA. |

| Providing Financial Advice | If the stablecoin is an “investment product,” providing financial advice requires authorisation under the FAA. |

Are stablecoins issued outside Singapore or pegged to non-G10 assets covered under MAS regulations, or governed differently (e.g., as digital payment tokens)?

Stablecoins issued outside of Singapore or pegged to non-G10 assets are covered under MAS regulations but are governed differently than the rigorously regulated SCS issued in Singapore. These stablecoins fall under the general regulatory regime for DPTs. The regulatory treatment is structured in two distinct tiers.

1. Non-SGD/G10 Pegged Stablecoins (Lower Tier Regulation)

Stablecoins that are fiat-referenced but not pegged to the Singapore Dollar (SGD) or a G10 currency are regulated under the general DPT regulatory regime. For example, stablecoins pegged to currencies such as the Chinese Yuan are treated as Digital Payment Tokens under the PSA. These stablecoins are subject to regulatory requirements focused on ensuring compliance with AML/CFT measures and addressing technology risk. They are not subject to the additional reserve management, redemption, and financial stability requirements of the Stablecoin Regulatory Framework finalised on August 15, 2023. As such, they cannot be labelled as “MAS-regulated stablecoins.” Similarly, stablecoins that reference a basket of multiple currencies or other assets (such as commodities), or those that rely on algorithms to maintain value stability, do not meet the criteria for the SCS Framework and continue to be governed under the general DPT regime.

2. Stablecoins Issued Outside Singapore (Extraterritorial Application)

Stablecoins, including SCS pegged to SGD or G10 currencies, that are issued outside Singapore are regulated under the existing DPT regulatory regime and are explicitly excluded from using the “MAS-regulated stablecoin” label at the onset. These stablecoins are not prohibited from circulation or use within Singapore, but they are treated as DPTs under the PSA. The MAS Stablecoin Regulatory Framework requires that, in order for an SCS to be recognised and labelled as an “MAS-regulated stablecoin,” the stablecoin must be issued solely out of Singapore and in no other jurisdiction.

MAS maintains this restriction because it is currently difficult to establish regulatory equivalence and supervisory cooperation with other jurisdictions given the early global state of stablecoin regulation, and because current technical standards make it difficult to trace the issuance origin of SCS once tokens are commingled. It is also challenging to monitor and verify the adequacy and availability of reserve assets held in overseas jurisdictions for redemption requests in Singapore.

Issuers of foreign stablecoins providing DPT services in Singapore, such as exchanging stablecoins for fiat currency, must comply with the PSA. This includes obtaining necessary DPT licenses, maintaining a permanent place of business or registered office in Singapore, and meeting AML/CFT and financial requirements. MAS further assesses whether the regulatory environment in the issuer’s home jurisdiction provides a comparable level of consumer protection and financial stability. MAS has also indicated that it will continue to monitor global regulatory and technical developments and may consider cooperative regulatory mechanisms as stablecoin regimes mature internationally.

Who is required to register or obtain a license to issue, manage, or facilitate stablecoin activities in or from Singapore?

The requirement to register or obtain a license for stablecoin-related activities in or from Singapore depends on the type of service provided, the volume of issuance, and the nature of the stablecoin itself, including whether it is classified as a DPT under the PSA or as a Capital Markets Product under the SFA. Licensing obligations are determined primarily by the PSA and SFA frameworks.

I. Licensing for Issuance and Management (PSA)

Stablecoins are primarily regulated as DPTs under the PSA. In August 2023, the MAS finalised the Stablecoin Regulatory Framework, introducing a new regulated activity category relating to stablecoin issuance.

A. Issuers of MAS-Regulated Stablecoins (SCS)

Only issuers of SCS pegged to the Singapore Dollar (SGD) or G10 currencies and issued solely out of Singapore are eligible to apply for the “MAS-regulated stablecoin” label.

| Activity | Licensing Requirement (Reference: PSA & Stablecoin Regulatory Framework) |

| Issuance (Volume > S$5 Million) | Issuers of SGD/G10-Pegged SCS where total issuance exceeds S$5 million must be licensed as a Major Payment Institution (MPI) to conduct the Stablecoin Issuance Service (SIS). SIS includes issuance, custody of SCS issued by the issuer, and management of reserve assets. |

| Issuance (Volume ≤ S$5 Million) | Issuers with total SCS issuance equal to or below S$5 million must be licensed for providing a DPT service. They are not subject to the SCS Framework’s additional requirements but may voluntarily apply for an MPI license to conduct SIS and obtain “MAS-regulated stablecoin” status. |

| Bank Issuers | Banks issuing MAS-regulated SCS backed by segregated reserve assets are generally exempt from PSA licensing due to regulation under the Banking Act. However, they must still comply with most SCS Framework requirements (excluding certain prudential obligations). Tokenised bank liabilities are excluded entirely from the SCS Framework. |

B. Intermediaries and Providers of General DPT Services

Any entity providing services related to stablecoins treated as DPTs must be licensed under the PSA.

| Activity | Licensing Requirement (Reference: PSA) |

| Dealing in DPTs | Buying or selling DPTs in exchange for money or other DPTs requires a license. |

| Facilitating Exchange of DPTs | Operating a platform that allows persons to exchange DPTs requires a license. |

| DPT Transfer Services | Accepting or arranging transfers of DPTs between accounts requires a DPT transfer service license. |

| Custodial Wallet Services | Safeguarding a DPT or DPT instrument (where the provider has control) requires a license. |

| DPT Inducement Services | Inducing or attempting to induce persons to enter into DPT transactions requires a license. |

Foreign companies conducting any of these services in Singapore must also be licensed under the PSA. They must have a permanent place of business or registered office in Singapore, and at least one executive director who is a Singapore citizen or Permanent Resident.

II. Licensing for Capital Markets Activities (SFA / FAA)

If a stablecoin possesses characteristics of a Capital Markets Product (e.g., a security, debenture, or unit in a Collective Investment Scheme), activities relating to it are subject to the SFA and the FAA.

| Activity | Licensing Requirement |

| Offer or Issue (as Security / CIS) | The offering must comply with Part XIII of the SFA, generally requiring a registered prospectus unless an exemption applies. |

| Dealing in the Stablecoin (as Security) | A person carrying on the business of dealing must hold a Capital Markets Services Licence, unless exempt. |

| Operating a Trading Platform | Operating a platform for trading such stablecoins may constitute operating an organised market, requiring approval as an Approved Exchange or recognition as a Recognised Market Operator. |

| Providing Custodial Services | Custodial services relating to such capital markets products are regulated under the SFA. |

| Providing Financial Advice | Providing advice on stablecoins treated as investment products requires authorisation under the FAA. |

Entities holding CMS or financial adviser licenses must also comply with AML/CFT requirements under MAS notices relating to the SFA and FAA.

What types of licences or registrations are available for stablecoin-related activities, and which specific services or functions does each category permit?

The regulation of stablecoin-related activities in Singapore relies on multiple licensing and registration frameworks administered by the MAS. The specific license required depends on whether the stablecoin is treated as a DPT under the PSA 2019 or as a Capital Markets Product under the SFA.

I. PSA Licenses (DPT Services)

Stablecoins are primarily classified as DPTs. Any entity providing services related to DPTs must obtain a license under the PSA.

A. DPT Service Licenses (General Intermediaries)

The two main DPT licenses regulate the scope and scale of stablecoin-related activities.

| Licence Type | Threshold / Scope | Permitted Stablecoin Services |

| SPI Licence | Applies if the total monthly payment transaction value is S$3 million or less for any single service, or S$6 million or less for two or more payment services. | SPI licensees may provide any combination of the seven regulated payment services. These services include the full scope of Digital Payment Token (DPT) Services. (Section 6(4), PSA) |

| MPI Licence | Required if transaction thresholds are exceeded (above S$3 million for a single service or S$6 million for multiple services in a month, averaged over a year). | MPI licensees may provide DPT Services and are subject to more comprehensive and extensive regulation. (Section 6(4) & 6(5), PSA) |

Specific DPT Services applying to stablecoins under the PSA include:

Dealing in DPTs; Facilitating the exchange of DPTs; DPT transmission or arrangement services; DPT inducement services; and custodial wallet services involving safeguarding the DPT or DPT instrument where the provider has control.

B. Stablecoin Issuance Service (SIS) Licence (MAS-Regulated Stablecoins)

The Stablecoin Issuance Service (SIS) was introduced as a new regulated activity under the PSA through the Stablecoin Regulatory Framework finalised on August 15, 2023.

| Licence Type | Issuance Threshold / Scope | Permitted Functions (SIS) |

| Major Payment Institution (MPI) License for SIS | Required for non-bank issuers of Single-Currency Stablecoins (SCS) pegged to SGD or G10 currencies where circulation exceeds S$5 million. | SIS includes issuance (minting and burning), custody of SCS issued by the issuer, and management of the reserve assets backing the SCS, subject to strict prudential, reserve, and redemption requirements. (Section 6, PSA & SCS Framework (MAS, August 2023)) |

| SPI/MPI (Voluntary SIS) | Issuers below S$5 million circulation must hold a DPT service license (typically SPI). They may voluntarily apply for an MPI license for SIS to comply with the SCS framework and use the “MAS-regulated stablecoin” label. | Voluntary compliance requires meeting all SCS Framework requirements, including 100% reserve backing, segregation, redemption rights, and transparency. (Section 6, PSA & SCS Framework) |

II. SFA Licenses (Capital Markets Activities)

If a stablecoin is determined to be a Capital Markets Product (e.g., a security, debenture, or unit in a Collective Investment Scheme), the following licenses or approvals under the SFA apply:

| Licence / Approval Type | Permitted Function |

| Capital Markets Services (CMS) Licence | Required for entities carrying on business in regulated activities such as dealing in capital markets products, fund management or REIT management, and providing custodial services in relation to capital markets products. (Section 82(1), SFA & Second Schedule, SFA; SFA Part IV, Division 1; SFA Section 321) |

| Approved Exchange (AE) or Recognised Market Operator (RMO) | Required for a person who establishes or operates a trading platform or organised market in Singapore for stablecoins constituting securities, derivatives contracts, or units in a CIS. (SFA, Part III, Section 30 & 32) |

| Financial Adviser’s (FA) Licence | Required for persons providing financial advice in Singapore in respect of any stablecoin categorised as an “investment product.” |

A CMSL may be held as a limited-activity CMSL where the licensee does not carry customer positions, margins, or assets. Foreign entities carrying out activities that would require authorisation if carried out in Singapore are recognised as regulated financial institutions.

What is the process and timeline for obtaining a stablecoin licence or registration, and what key documents are required?

The process and key requirements for obtaining a stablecoin license in Singapore are governed primarily by the PSA, which regulates DPT services and the SIS. All licensing applications are submitted to and assessed by the MAS.

1. Licensing and Registration Types

Stablecoin activities generally require either a SPI Licence or a MPI Licence.

SPI Licence

Required where the total issuance of SCS in circulation is S$5 million or below.

- Application Fee: S$1,000

- Annual Fee: S$2,500 to S$5,000

MPI Licence

Required for entities issuing SCS (pegged to SGD or G10 currencies) where total issuance exceeds S$5 million. This license is required to conduct the SIS and to label the token as an “MAS-regulated stablecoin.”

- Application Fee: S$1,500

- Annual Fee: S$5,000 to S$10,000

Voluntary MPI

Issuers below the threshold may voluntarily apply for an MPI licence to comply with SCS regulatory requirements and obtain the MAS-regulated status.

2. Key Process Steps and Timeline (DPT/SIS Licensing)

The licensing process involves satisfying MAS admission requirements and providing detailed documentation via Form 1.

| Stage | Description | Timeline / Reference |

| I. Preliminary Clarification | Applicant may clarify licensing or sandbox-related matters with MAS. | Prior to submission. |

| II. Application Submission | Submission of Form 1 and payment of application fee, demonstrating ability to meet compliance obligations. | Application stage. |

| III. Suitability Assessment | MAS reviews application and provides preliminary indication of suitability for sandbox within 21 working days of full submission (T0). | Within 21 working days. |

| IV. Interview | MAS case officer interviews key management regarding business operations and risk controls (consultants/legal advisors cannot attend). | Part of review process. |

| V. Grant/Refusal | MAS grants licence if applicant is fit and proper, financially sound, and consistent with public interest. | Upon approval. |

Note: MAS may place applications on hold for up to six months if significant revisions or readiness gaps exist. Applicants must notify MAS immediately of any changes after submission.

3. Key Documents and Information Required

MAS requires comprehensive documentation covering governance, capital adequacy, operational controls, risk management, and technology infrastructure.

A. Governance, Corporate Structure, and Personnel

The applicant must be a Singapore-incorporated company or a foreign-incorporated corporation with a permanent place of business or registered office in Singapore. At least one executive director must be a Singapore citizen or Permanent Resident, or alternatively, an employment pass holder where another director is a citizen or PR. A complete shareholding chart up to the ultimate natural person controllers must be provided. MAS must be satisfied that all key persons are fit and proper and have relevant industry competency. CVs of compliance officers and AML/CFT officers must be submitted.

B. Financial, Capital, and Operational Requirements

Applicants must provide a detailed business plan, demonstrating capacity to meet prudential requirements. MPI applicants must show ability to maintain minimum base capital (S$250,000 for MPI generally; higher of S$1 million or 50% of annual operating expenses for MAS-regulated SCS issuers). MPI applicants must also provide the required security deposit (S$100,000 or S$200,000 depending on volume) and submit detailed fund flow diagrams. SPI applicants must document systems for monitoring threshold compliance.

C. Compliance and Risk Management

A legal opinion from a Singapore-qualified law firm is mandatory for new SPI/MPI applications, summarising the business model and confirming PSA applicability. Applicants must submit AML/CFT policies consistent with MAS Notices PSN01 and PSN02, an enterprise-wide ML/TF and PF risk assessment (EWRA), and an external auditor’s independent assessment (signed within the last 3 months) confirming compliance. Where online services are provided, penetration testing and remediation of high-risk findings are required. Consumer asset safeguarding and complaints handling policies must also be provided.

D. Stablecoin Issuance Specific Requirements (MAS-Regulated SCS Issuers)

Issuers must submit the White Paper that will be published, detailing the value-stabilising mechanism, technology, risks, and redemption rights. A reserve asset management plan must describe segregation, custody arrangements, and daily/attestation processes. Issuers must also provide operational SLAs, including disaster recovery and business continuity arrangements.

Can foreign or offshore stablecoin issuers operate in Singapore, and what local presence or conditions are required?

Foreign or offshore stablecoin issuers can operate and provide services in Singapore, but the conditions and requirements vary depending on the nature of the stablecoin and the specific services offered.

I. Licensing and Conditions for Foreign Entities Providing DPT Services

Stablecoins are generally classified as DPTs under the PSA. Foreign entities seeking to offer stablecoin-related DPT services in Singapore must be licensed by the MAS and must meet local presence requirements.

Any entity, including foreign issuers or intermediaries, carrying on a business of providing DPT services in Singapore, such as buying, selling, exchanging, transferring DPTs, or providing custodial wallets, must obtain either a SPI Licence or a MPI Licence under the PSA.

A foreign corporation applying for an SPI or MPI license must meet incorporation and operational presence conditions in Singapore. The applicant must be a company incorporated in Singapore or a corporation formed or incorporated outside Singapore and must establish a permanent place of business or registered office in Singapore. The applicant must have at least one executive director who is a Singapore citizen or Permanent Resident (PR), or may be an Employment Pass holder if another director is a Singapore citizen or PR, and is expected to be resident in Singapore to oversee operations. A licensee must also appoint at least one person present at the business location to address customer or user queries. Books and records relating to the payment services provided must be kept at the Singapore business location.

II. Restrictions on Foreign Issuers Seeking the “MAS-Regulated” Label

The Stablecoin Regulatory Framework (finalised on August 15, 2023) imposes a strict territorial requirement for stablecoins seeking the “MAS-regulated stablecoin” designation. Issuers of SCS) pegged to the Singapore Dollar (SGD) or G10 currencies must issue the SCS solely out of Singapore to qualify for the label. MAS does not allow multi-jurisdictional issuance at this stage because global regulatory coordination remains limited, current technical standards make issuance tracing difficult once tokens are commingled, and oversight of reserve assets held abroad presents operational challenges. MAS has indicated that this position may evolve as global regulatory cooperation strengthens.

III. Regulation of Foreign-Issued Stablecoins (Non-MAS Regulated)

Stablecoins issued outside of Singapore are not prohibited from being used or circulated within Singapore; however, they are regulated under the general DPT regime in the PSA. To be recognised for circulation or trading in Singapore, a foreign-issued stablecoin must meet expectations related to reserve asset adequacy, consumer protection, and transparency.

This includes demonstrating that reserves fully back the token in liquid and high-quality assets, segregated from the issuer’s own assets, and held in the same currency as the stablecoin. The issuer must conduct and publish monthly independent reserve attestations and submit an annual audit to MAS. MAS will also review the regulatory regime in the issuer’s home jurisdiction to assess comparability in consumer protection and financial stability. If deficiencies are identified, MAS may require additional safeguards.

IV. Extraterritorial AML/CFT Oversight

MAS intends to expand the legislative scope of the PSA to impose AML and CFT requirements on entities incorporated in Singapore even if they provide DPT services outside Singapore. This development aligns Singapore’s framework with enhanced FATF standards. MAS has noted that Singapore-incorporated entities offering services solely outside Singapore may pose elevated ML/TF risk due to a lack of direct regulatory supervision in the foreign jurisdiction.

Are any exemptions or waivers available to entities already regulated under other Singapore financial laws?

Singapore’s regulatory framework for stablecoins provides specific exemptions and differentiated treatment for entities already regulated under other major financial statutes administered by the MAS. These exemptions generally fall under the PSA and the SFA regimes.

1. Exemptions and Differentiated Treatment under the PSA

Stablecoins are generally classified as DPTs, and their issuance is regulated as a SIS under the PSA.

A. Banks and DTIs

Financial institutions already subject to comprehensive prudential oversight, such as licensed banks, merchant banks, and finance companies, receive specific exemptions related to licensing and prudential requirements, but generally not from conduct rules.

| Entity | Reference Act | Exemption/Waiver |

| Licensed Banks | Banking Act 1970 | Banks, merchant banks, and finance companies are generally categorised as exempt payment service providers under the PSA. |

| Tokenised Bank Liabilities | Banking Act 1970 | Stablecoins issued as tokenised bank liabilities (e.g., tokenised deposits) are excluded from the scope of the stringent Stablecoin Regulatory Framework (SCS Framework). MAS excluded this due to differences in value-stabilising mechanisms and because banks are already subject to prudential requirements under the Banking Act. |

| Bank Issuers of Reserve-Backed SCS | Banking Act 1970 | Banks issuing MAS-regulated SCS backed by segregated reserve assets are exempt from complying with the prudential requirements of the SCS Framework (such as minimum base capital and minimum liquid assets). |

Note: DTIs (banks, merchant banks, finance companies) are not exempt from PSA requirements relating to e-money issuance services and DPT services. They are treated the same as other licensees for DPT-related activities to maintain competitive neutrality. However, where a bank issues an MAS-regulated SCS backed by segregated reserves, it is exempt from certain prudential rules under the SCS Framework but must still comply with all other SCS requirements (e.g., 100% reserve backing, segregation, redemption rights, and disclosures).

B. Credit Card Issuers

Non-bank issuers of credit cards or charge cards are generally exempted from PSA licensing requirements because they are already required to hold a license under the Banking Act for credit facility provision. They must still comply with PSA requirements that do not overlap with Banking Act regulations.

2. Exemptions under the SFA and FAA

If a stablecoin is classified as a Capital Markets Product (e.g., a security or CIS unit), the SFA and FAA apply.

A. Exemptions for FAA

Entities already regulated for dealing in financial products may be exempt from obtaining a separate Financial Adviser’s Licence (FA Licence) where advice is incidental to their main regulated activity. This includes licensed banks, merchant banks, insurers, and holders of a Capital Markets Services (CMS) Licence dealing in capital markets products.

B. Exemptions for Capital Markets Dealing (SFA)

Under the SFA, certain activities may be carried out without holding a full CMS Licence. These include:

- Incidental Activity: An approved exchange, recognised market operator, or approved holding company may be exempt for regulated activities incidental to its primary function.

- Proprietary Trading: Entities may be exempt when dealing in stablecoins (classified as securities) for their own account through regulated financial institutions.

- General MAS Exemptions: MAS has authority to exempt any person or class of persons from provisions of the SFA.

3. MAS General Power to Waive Requirements

MAS retains broad discretionary authority to grant exemptions:

- General Waiver Power (PSA): MAS may exempt any person from any PSA provision where appropriate.

- FinTech Regulatory Sandbox: Entities testing novel stablecoin structures or technologies may apply to enter a sandbox where MAS relaxes selected legal and regulatory requirements (e.g., license fees, minimum paid-up capital, minimum liquid assets, or technology risk guidelines) for the sandbox duration.

What are the minimum capital or liquidity requirements applicable to licensed stablecoin issuers and service providers?

The minimum capital and liquidity requirements applicable to licensed stablecoin issuers and service providers in Singapore depend on whether the entity is the issuer of a regulated SCS or an intermediary providing DPT services. These obligations arise primarily under the MAS Stablecoin Regulatory Framework and the PSA.

1. Requirements for Licensed MAS-Regulated Stablecoin Issuers

These specialised prudential requirements apply to non-bank entities licensed for the SIS under the PSA, specifically for SCS pegged to the Singapore Dollar (SGD) or any G10 currency, where the total value in circulation exceeds S$5 million. Banks issuing MAS-regulated stablecoins backed by segregated reserve assets are generally exempt from these prudential rules, given their pre-existing regulation under the Banking Act.

A. Base Capital Requirements

SCS issuers are required to maintain a minimum base capital that is the higher of S$1 million or 50% of the issuer’s annual operating expenses (OPEX). This capital buffer ensures solvency and operational resilience in the event of financial stress.

B. Solvency and Liquid Asset Requirements

SCS issuers must hold sufficient liquid assets at all times to meet operational and recovery obligations. The detailed requirements include:

- Liquid Asset Valuation: Issuers must hold liquid assets valued at the higher of 50% of annual operating expenses or the amount assessed by the issuer to achieve recovery or orderly wind-down.

- Verification: The amount assessed for recovery or wind-down must be independently verified and audited annually.

- Eligible Liquid Assets: These may include cash and cash equivalents, government debentures, negotiable certificates of deposit, and money market funds.

C. Reserve Asset Requirements (Liquidity and Backing)

To ensure value stability and redemption capacity, MAS-regulated SCS issuers must maintain reserve asset coverage:

- Full Reserve Backing: Reserves must always equal 100% of the par value of the stablecoins in circulation.

- Asset Composition and Maturity: Reserves must be held in low-risk, highly liquid assets, denominated in the pegged currency, such as cash, cash equivalents, or debt securities with a maximum residual maturity of three months.

- Segregation: All reserve assets must be held in segregated accounts on trust, separate from the issuer’s operational funds, to ensure insolvency protection and clear redemption rights.

2. Requirements for Stablecoin Service Providers (Intermediaries)

Entities that provide services related to stablecoins, such as dealing, transfer, exchange, or custodial wallet operations, are regulated as DPT service providers under the PSA. The type of license depends on transaction volume, distinguishing SPI from MPI.

A. SPI Requirements

Entities conducting DPT services below the prescribed thresholds must obtain an SPI license.

| Requirement | Description |

| Base Capital | Minimum initial and ongoing capital requirement of S$100,000. |

| Volume Thresholds | SPIs are limited to total monthly payment transaction values of S$3 million or less for a single payment service, or S$6 million or less for multiple payment services. |

B. MPI Requirements

Entities exceeding the SPI thresholds, or issuers of SCS with circulation above S$5 million, must hold an MPI license and comply with stricter prudential and capital requirements.

| Requirement | Description |

| Base Capital | Minimum initial and ongoing financial requirement of S$250,000. |

| Security Deposit | MPIs must maintain a security deposit for customer protection:

|

How are stablecoin reserve assets required to be structured, managed, and safeguarded under the Singapore regulations, and what segregation, custody, and reconciliation standards must licensed custodians and trading platforms follow?

The regulation of stablecoin reserve assets in Singapore, particularly for SCS pegged to the Singapore Dollar (SGD) or any G10 currency and issued by non-bank entities under the MAS Stablecoin Regulatory Framework finalised in August 2023, imposes strict standards for their structure, management, safeguarding, and auditing. In addition, licensed DPT service providers, including intermediaries and trading platforms, that deal with MAS-regulated stablecoins must comply with specific segregation and custody requirements to protect customer funds in the event of insolvency.

I. Structure and Composition of Stablecoin Reserve Assets (MAS-Regulated SCS Issuers)

MAS requires MAS-regulated SCS issuers to maintain reserve portfolios that are extremely low-risk and highly liquid to ensure value stability and redemption confidence.

A. Full Backing and Denomination: Issuers must maintain reserves that are at least equivalent to 100% of the par value of all outstanding SCS in circulation at any given time. They are also required to maintain a risk management policy that continuously reviews and determines appropriate buffers to guarantee that the 100% reserve valuation is maintained under all circumstances. Furthermore, the reserve assets must be denominated in the same currency as the stablecoin peg, for example, reserves for an SGD-pegged SCS must be held in Singapore Dollars to eliminate foreign-exchange volatility.

B. Eligible Asset Classes and Maturity: Reserve assets must consist solely of low-risk and highly liquid instruments. These include cash, cash equivalents, and debt securities with a maximum residual maturity of three months. Such debt securities must be issued either by the government or central bank of the pegged currency, or by an organisation of both governmental and international character that holds a minimum credit rating of “AA-.”

II. Management, Valuation, and Reconciliation (SCS Issuers)

A. Daily Valuation and Management: Issuers are required to perform daily mark-to-market valuation of their reserve assets to ensure that the value of the reserves remains fully aligned with the total SCS in circulation. In addition, issuers must maintain a comprehensive and risk management policy that identifies and mitigates credit, liquidity, and concentration risks associated with their reserve portfolios.

B. Auditing and Attestation Standards: To uphold transparency and regulatory confidence, issuers must follow a rigorous audit and attestation process. Independent attestations of reserve adequacy must be carried out every month by qualified external parties. The results of these attestations must be made publicly available on the issuer’s website and simultaneously submitted to MAS no later than the end of the following month. Furthermore, a comprehensive annual audit of the reserve assets must be undertaken, with the resulting audit report submitted directly to MAS for verification and supervisory review.

III. Segregation and Custody Requirements (SCS Issuers)

MAS places particular emphasis on segregation and custody to ensure that reserve assets are protected and remain accessible to token holders even in the event of an issuer’s insolvency, thereby achieving true insolvency remoteness.

A. Segregation: All reserve assets must be held in segregated trust accounts separate from the issuer’s own operational and corporate funds. This legal and operational segregation ensures that customer reserve assets are ring-fenced from other obligations of the issuer and are protected from creditor claims.

B. Eligible Custodians: Reserve assets must be held only with permitted custodians meeting MAS standards. Eligible custodians include financial institutions licensed in Singapore to provide custodial services, or overseas-based custodians that satisfy stringent conditions. An overseas custodian must have at least a minimum long-term credit rating of “A-” and must maintain a branch in Singapore that is regulated by MAS to provide custodial or safekeeping services.

IV. Requirements for Licensed Intermediaries (Custody and Trading Platforms)

Licensed intermediaries, such as exchanges, custodians, and other DPT service providers that handle MAS-regulated stablecoins, are subject to additional obligations concerning segregation, disclosure, and operational safeguards.

SCS intermediaries must segregate customers’ holdings of MAS-regulated stablecoins from their own proprietary assets to prevent commingling and misuse of client funds, particularly in the event of insolvency. While intermediaries are required to keep firm assets separate from customer assets, MAS permits the commingling of different customers’ SCS (and other DPTs) within a single aggregated pool, provided that this pooled account remains entirely distinct from the intermediary’s own assets. Intermediaries must disclose the potential risks associated with such commingling arrangements to their customers clearly and transparently, and they must describe the risk-mitigation measures implemented to protect client interests.

Furthermore, intermediaries are required to establish effective operational systems and internal controls to safeguard the integrity and security of customer assets. This includes the secure management of cryptographic keys used for custodial wallets. In line with MAS’s expectations, intermediaries must adopt the “never-alone” principle, ensuring that no single individual or system component can unilaterally access an entire cryptographic key. This typically involves techniques such as network isolation, multi-party computation, and key component segregation, reinforcing the protection of clients’ digital assets.

What restrictions apply to the use of stablecoin reserve assets by licensed custodians and trading platforms in Singapore, particularly regarding investing, lending, or staking client assets?

The restrictions on the use of reserve assets for SCS and client assets held by licensed custodians and trading platforms in Singapore are among the strictest globally. These measures are designed to maintain value stability, ensure insolvency remoteness, and mitigate any risk of misuse.

The rules differentiate between the obligations of (i) issuers of MAS-regulated stablecoins : where restrictions apply to the use of reserve assets and (ii) licensed intermediaries (custodians and trading platforms): where restrictions apply to the use of client assets classified as DPTs.

I. Restrictions on MAS-Regulated Stablecoin Issuers (Reserve Assets)

For entities licensed to conduct the SIS under the PSA for SCS pegged to the Singapore Dollar (SGD) or G10 currencies, MAS imposes strict business prohibitions and operational ringfencing requirements. These restrictions directly determine how reserve assets may and may not be used by the issuing entity.

A. Prohibition on Non-Issuance Services: An SCS issuer is explicitly prohibited from engaging in any other non-issuance service within the same legal entity. This prohibition is intended to ringfence the issuer from unrelated financial or commercial risks in lieu of a more complex capital adequacy framework. Consequently, the SCS issuer cannot provide lending, staking, trading, or fund management services, nor engage in investment or credit-extending activities. Specifically, the lending or staking of MAS-regulated stablecoins or other DPTs is entirely prohibited, ensuring that the issuer is never exposed to third-party credit or counterparty risk. Likewise, the issuer is prohibited from investing in or extending loans to other companies, preventing the deployment of reserve assets for speculative or unrelated purposes. Trading of digital payment tokens by the issuer itself is also disallowed, as is the provision of fund management services.

In practice, this means that the reserve assets themselves cannot be used to finance or support any form of business activity undertaken by the SCS issuer. However, related business activities (such as trading or investment services) may still be conducted by other affiliated entities, provided that the SCS issuer does not have any ownership stake in such entities. This structural separation ensures that the issuer’s solvency and its reserve integrity remain wholly insulated from the financial risks of its affiliates.

B. Reserve Asset Composition (Limiting Investment Risk): The composition of reserve assets is deliberately constrained to low-risk, short-term, and highly liquid instruments. Reserve assets must consist entirely of cash or cash equivalents, and may include debt securities with a residual maturity not exceeding three months. These debt securities must be issued either by the government or central bank of the pegged currency, or by an international or governmental organisation with a minimum credit rating of “AA-.” This narrowly defined asset class effectively eliminates exposure to market volatility or credit deterioration, ensuring that the reserves are always redeemable at par value. The structure therefore precludes the use of reserves for any form of investment activity that could generate yield but simultaneously introduces liquidity, duration, or counterparty risk.

II. Restrictions on Licensed Intermediaries (Custodians and Trading Platforms)

Entities providing intermediation services related to MAS-regulated SCS, such as exchanges, custodians, and wallet providers, are licensed as Digital Payment Token Service Providers (DPTSPs) under the PSA. These entities are subject to stringent asset segregation requirements and operational prohibitions that collectively prevent them from using client stablecoins for lending, staking, or investment purposes.

A. Prohibition on Granting Credit Facilities: Licensed DPT service providers are strictly prohibited from engaging in credit or lending activities involving client assets. Specifically, a licensee must not carry on the business of granting any credit facility to any individual in Singapore. Furthermore, a licensee providing an e-money issuance service is expressly prohibited from lending any customer funds or using customer money to finance its business operations. Although SCS fall under the DPT category when handled by intermediaries, the same principle applies: client stablecoins must not be lent, staked, or used to generate yield. This prohibition ensures that customer assets are insulated from business risks and reinforces the framework’s foundational principle, that reserve and client assets must remain fully redeemable and bankruptcy-remote.

B. Segregation and Custody Requirements: Intermediaries dealing in MAS-regulated stablecoins must fully segregate customers’ holdings of SCS from their own proprietary assets. This segregation ensures that customer funds cannot be misused or exposed to operational liabilities. While intermediaries must separate firm assets from customer assets, MAS permits commingling among customers in a collective pool, provided the pooled account is ringfenced and legally distinct from the firm’s own funds. This allows custodians and exchanges to manage liquidity more efficiently while maintaining clear legal separation from corporate assets.

Under this regime, any investment, lending, or staking of client stablecoins would directly violate the segregation principle, as client assets are required to be held in trust accounts solely for the benefit of customers. This structure ensures that customer assets remain protected and retrievable even in the event of insolvency. During MAS’s consultation process, industry participants underscored the importance of maintaining this separation, and MAS affirmed that entities providing transmission or custody services for MAS-regulated SCS are strictly prohibited from using customers’ stablecoins for lending or yield-generating purposes.

What redemption rights and timelines must be maintained for stablecoin holders under the Singapore regulations?

The Singapore regulatory framework, finalised by the MAS in August 2023, establishes mandatory redemption rights and strict timelines specifically for holders of MAS-regulated SCS, which are fiat-referenced stablecoins pegged to the Singapore Dollar (SGD) or any G10 currency and issued in Singapore above a circulation threshold of S$5 million.

I. Redemption Rights and Requirements

1. Direct Legal Claim and Par Value Redemption

MAS-regulated SCS issuers must provide holders with a direct legal claim for redemption at par value. This guarantees that users can exchange their stablecoins for the equivalent amount of the pegged fiat currency (1:1 with the pegged currency).

2. Redeemable Anytime

SCS holders must be able to make redemption requests at any time. The issuer must offer a mechanism allowing holders to redeem their stablecoins.

3. Full Reserve Backing

The guarantee of redemption at par is underpinned by the requirement that issuers must maintain reserves equal to 100% of the par value of the circulating stablecoins at all times. These reserves must be highly liquid to ensure the issuer can honor redemption requests.

4. Disclosure of Redemption Conditions

Any redemption conditions (if any) imposed by the issuer must be reasonable and clearly disclosed upfront. Issuers must clearly communicate the redemption process, including all terms and conditions, so users are fully aware of their redemption rights.

II. Redemption Timelines

The regulations specify a maximum period for fulfilling a legitimate redemption request:

III. Intermediary Transfer Timeline

While the 5-day limit applies to redemption from the issuer, intermediaries providing DPT services related to SCS are subject to a different transfer timeline:

SCS Transmission Timeline: MAS-regulated stablecoins must be transmitted by the intermediaries within three business days from a payer to a payee. This timeline mirrors the existing money transmission requirement for domestic money transfer services.

What happens to stablecoin holders’ assets if an issuer or custodian becomes insolvent?

The Singapore regulatory framework, particularly for SCS regulated by the MAS, incorporates explicit safeguards to protect stablecoin holders’ assets in the event that an issuer or custodian/intermediary becomes insolvent. The primary objective of these requirements is to achieve insolvency remoteness, ensuring that customer assets remain legally segregated from the firm’s assets and liabilities, and are therefore insulated from bankruptcy proceedings. The framework provides clear, distinct protections for the assets held by (i) the stablecoin issuer and (ii) the licensed custodian or trading platform.

I. Insolvency of the Licensed SCS Issuer (Non-Bank)

The MAS Stablecoin Regulatory Framework imposes stringent measures on licensed non-bank issuers of MAS-regulated stablecoins, that is, SCS pegged to the Singapore Dollar (SGD) or G10 currencies, where circulation exceeds S$5 million, to ensure that reserve assets remain protected and accessible for redemption even in the event of the issuer’s insolvency.

A. Protection of Reserve Assets: The principal safeguard against issuer insolvency lies in the treatment and management of reserve assets. Issuers must ensure that all reserve assets backing the stablecoins, equivalent to 100% of the par value of SCS in circulation, are held in segregated accounts on trust. This legal and operational segregation guarantees that the reserve assets remain distinct from the issuer’s other assets. Because the reserves are held on trust, they do not form part of the issuer’s bankruptcy estate if insolvency or winding-up proceedings occur. Furthermore, holders of the stablecoin are granted a direct legal claim against the issuer and/or the underlying reserve assets. This legal entitlement ensures that stablecoin holders retain redemption rights even during insolvency proceedings, providing them direct recourse to the reserve pool rather than relying on unsecured creditor recovery.

B. Redemption and Orderly Wind-Down: In the event that an issuer faces financial distress, the regulatory framework mandates that it maintain sufficient buffers to facilitate an orderly wind-down process without jeopardising the reserve assets. Issuers are required to hold additional liquid assets—separate from the 100% reserve backing—to cover operational expenses and to fund an orderly recovery or dissolution process. These liquid assets serve as a financial cushion to wind down business operations smoothly while preserving the full value of the customer-backed reserves.

To prevent financial instability, issuers are also prohibited from engaging in non-issuance business activities, such as lending, staking, or investing, ensuring that no external market or credit risk can contaminate the issuer’s financial health. This ringfencing is designed to act as a substitute for a complex, risk-based capital regime. However, it is important to note that MAS-regulated SCS are not classified as deposits, and therefore do not fall under the Deposit Insurance Scheme. The protection for SCS holders arises not from insurance coverage, but from segregation of assets, full reserve backing, and legally enforceable redemption rights.

II. Insolvency of the Licensed Custodian or Trading Platform (Intermediary)

Entities providing custody or trading services for stablecoins, regulated as DPTSPs under the PSA, must comply with stringent user protection and segregation requirements designed to safeguard customer assets in the event of their insolvency. These protections are codified in recent regulatory amendments coming into force in October 2024, specifically targeting the handling of DPTs and stablecoins.

A. Segregation of Customer DPTs: When a DPTSP becomes insolvent, the regulations ensure that customer assets are legally distinct and protected from the firm’s creditors. Under the new framework, intermediaries must maintain segregation between customer assets and firm assets at all times. The MAS requires DPT service providers to place customers’ assets in a trust account held for the benefit of their clients. This legal arrangement ensures that customer holdings of MAS-regulated stablecoins are excluded from the intermediary’s property pool if insolvency occurs.

Although intermediaries must segregate customer assets from their own, MAS permits commingling among customers within a collective pool, provided this pool remains separate from the intermediary’s proprietary funds. This means that while individual customer segregation is not required, collective segregation at the trust-account level is mandatory. Intermediaries are obligated to disclose to customers the inherent risks of such commingling and the specific measures in place to mitigate them, such as transparent record-keeping, periodic reconciliation, and enhanced audit controls.

The intent behind this segregation framework is to ensure that in the event of insolvency, customer assets are fully protected. Previously, under the PSA, security deposits provided by MPIs for non-DPT services were already protected from being included in an insolvency estate. The new DPT-specific segregation requirements extend this same principle to digital assets, providing stablecoin and DPT holders with equivalent protection. In essence, customer stablecoins held in trust are not part of the custodian or trading platform’s assets and should therefore be returned to the rightful owners in a liquidation scenario.

B. Comparison to Traditional Money Safeguarding: It is important to distinguish the safeguarding requirements for DPTs and stablecoins from those applicable to traditional customer funds such as e-money or payment transfer funds. For traditional money, MPIs must safeguard customer funds using formal mechanisms such as bank undertakings, guarantees, or deposits in trust accounts. Historically, MPIs were not required to apply these same safeguarding measures to digital assets. However, under the 2024 amendments, DPTSPs must now apply equivalent segregation by maintaining trust accounts specifically for digital assets.

What AML/CFT obligations apply to stablecoin issuers and related service providers under Singapore’s Anti-Money Laundering Regulations?

AML/CFT obligations applicable to stablecoin issuers and related service providers in Singapore are primarily governed by the PSA and the accompanying Notices issued by the MAS. As stablecoins are generally categorised as a form of DPT, all entities engaged in their issuance, exchange, or custody are regulated as DPT service providers, subject to Singapore’s AML/CFT regime.

AML/CFT obligations applicable to stablecoin issuers and related service providers in Singapore are primarily governed by the PSA and the accompanying Notices issued by the MAS. As stablecoins are generally categorised as a form of DPT, all entities engaged in their issuance, exchange, or custody are regulated as DPT service providers, subject to Singapore’s AML/CFT regime.

I. General AML/CFT Obligations for All DPT Service Providers

Whether an entity operates as a stablecoin issuer providing the SIS or as an intermediary offering DPT services such as exchange or custody, it is regulated under the same AML/CFT framework that governs all DPT service providers. DPT-related activities are deemed to carry inherently higher ML/TF risks due to their anonymity, cross-border accessibility, and transaction speed. Consequently, no exemptions are provided from AML/CFT requirements for DPT or stablecoin-related activities.

Under the MAS regime, all service providers must first undertake a comprehensive risk assessment, taking appropriate steps to identify, assess, and understand their ML/TF risks. This includes performing specific risk assessments prior to launching new products, especially those that promote anonymity or novel transaction mechanisms. Service providers must then establish Policies, Procedures, and Controls (PPC) proportional to the size, nature, and complexity of their operations, ensuring these measures effectively mitigate identified risks.

A key component of AML compliance is the implementation of Customer Due Diligence (CDD) measures to identify and verify the identity of customers. In parallel, regulated entities must conduct ongoing transaction monitoring to detect, investigate, and report suspicious behavior indicative of illicit activities. Screening procedures are also mandatory and must be performed against relevant sanction lists to manage proliferation financing (PF) and other sanction-related risks.

In cases where screening results identify a match with a designated person or entity, the service provider must immediately freeze all related funds or digital assets (including stablecoins) and notify MAS without delay. Such freezes must be reported via a Suspicious Transaction Report (b) to the STRO of the CAD, no later than one business day after suspicion is established.

Further obligations include record keeping of all transactions and customer information, ensuring auditability and traceability of financial flows. Where higher ML/TF risks are identified, for instance, when dealing with unregulated entities or conducting operations outside Singapore, service providers are required to implement enhanced due diligence measures.

These general AML/CFT requirements are codified primarily in MAS Notice PSN02 (Notice on the Prevention of Money Laundering and Countering the Financing of Terrorism, Digital Payment Token Service), which is supplemented by detailed Guidelines to Notice PSN02 providing operational clarity on risk-based approaches and controls.

II. Specific AML/CFT Requirements for Stablecoin Issuers (MAS-Regulated SCS)

Issuers of MAS-regulated SCS, stablecoins pegged to the SGD or G10 currencies with circulation above S$5 million, are required to comply with the same AML/CFT standards applicable to all DPT service providers and, where relevant, banking institutions. The licensing process for stablecoin issuance is intentionally rigorous: applicants must demonstrate that they possess sound governance structures, internal controls, and compliance arrangements proportionate to the scale, nature, and complexity of their operations. MAS evaluates the effectiveness of these AML/CFT frameworks as part of the licensing assessment, ensuring that all stablecoin issuers maintain compliance before and after licensing.

III. Application of International Standards (FATF Travel Rule)

Singapore’s regulatory approach is fully aligned with the FATF international standards on AML/CFT for virtual assets. A critical element of this alignment is the implementation of the Travel Rule, which requires DPT service providers, including those handling stablecoins, to transmit and retain customer identification information during transactions between virtual asset service providers.

Under this rule, when a DPT or stablecoin transfer occurs between service providers, the originating provider must ensure that customer data accompanies the transaction, and the receiving provider must make such data available to competent authorities upon request. The wire transfer/value transfer policies of the provider must identify and close any compliance gaps relative to the FATF Travel Rule, as set out in paragraph 13-7 of the Guidelines to MAS Notice PSN02. These requirements are designed to prevent anonymous value transfers and to ensure traceability of digital asset movements across jurisdictions.

IV. Legal Framework for Combating Financial Crime

Beyond MAS’s AML/CFT Notices, Singapore’s broader legal framework for financial crime prevention reinforces the compliance duties of stablecoin issuers and DPT service providers. Three key statutes underpin these obligations:

CDSA

The Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act forms Singapore’s principal anti-money laundering legislation. It criminalises money laundering and imposes mandatory reporting duties on suspicious transactions to the STRO.

TSOFA

The Terrorism (Suppression of Financing) Act targets terrorism financing and prohibits the provision of financial services or assets to individuals or entities designated as terrorist-related.

FSMA

The Financial Services and Markets Act includes Sanctions Regulations mandating the freezing of funds or assets belonging to designated persons or entities in accordance with United Nations Security Council Resolutions (UN Regulations). These obligations extend to all Financial Institutions, including payment service providers, ensuring that the global sanctions regime is uniformly enforced within Singapore’s jurisdiction.

What corporate governance and senior management standards must licensed or registered entities follow?

The corporate governance and senior management standards applicable to licensed or registered entities in Singapore, particularly those engaged in stablecoin issuance, DPT services, or capital markets activities, are designed to uphold accountability, competence, ethical conduct, and effective risk management. These standards are primarily set under the PSA, the SFA, and the MAS guidelines, including the Individual Accountability and Conduct Regime and the Guidelines on Corporate Governance.

I. Senior Management Accountability and Conduct Regime

The MAS imposes comprehensive expectations on the governance and conduct of financial institutions through the Individual Accountability and Conduct Regime, which took effect in September 2021. This framework establishes clear accountability lines within licensed entities to ensure that boards and senior management exercise effective control, promote a strong compliance culture, and operate with integrity.

A. Individual Accountability and Responsibility: Under this regime, senior managers and key personnel bear explicit responsibility for ensuring that all operations are conducted ethically and in full compliance with applicable regulatory standards. MAS defines five key accountability outcomes, central to which is the clear identification of responsible senior managers for all core functions. The sole-proprietor, partners, directors, and the CEO of a licensed or registered entity bear ultimate responsibility for ensuring that the institution complies with all relevant laws and regulations.

Boards and senior management are expected to set the right tone from the top, ensuring business is conducted in a responsible, transparent, and professional manner. The governance framework must facilitate this by providing a clear and transparent management structure with defined reporting relationships and decision-making hierarchies that enable senior managers to discharge their duties effectively.

B. Fit and Proper Criteria: A foundational regulatory requirement for all financial institutions , including Payment Service Providers (PSPs), Capital Markets Services Licence (CMSL) holders, and Financial Advisers (FAs), is that both the entity and its key officers must satisfy the MAS Fit and Proper Criteria. MAS evaluates these individuals based on factors such as honesty, integrity, reputation, competence, capability, and financial soundness. Applicants must demonstrate that their directors, CEO, shareholders, and employees are free of adverse findings or reputational risks, particularly relating to financial crime or misconduct. MAS may deny or revoke a license if any such person fails to meet the fit and proper threshold.

II. Governance Requirements for Licensed PSPs

Entities licensed under the PSA, including Stablecoin Issuers and DPT Service Providers, must comply with detailed governance, ownership, and management requirements, applicable to both Standard Payment Institution (SPI) and Major Payment Institution (MPI) licensees.