Stablecoin Regulation in Hong Kong: A Complete FAQ Guide

What is a Stablecoin in Hong Kong?

Section 3 of the Hong Kong Stablecoin Ordinance defines: “…a stablecoin is a cryptographically secured digital representation of value that—

(a) is expressed as a unit of account or store of economic value;

(b) is used, or intended to be used, as a medium of exchange accepted by the public for any one or more of the following purposes—

(i) payment for goods or services;

(ii) discharge of a debt;

(iii) investment;

(c) can be transferred, stored or traded electronically;

(d) is operated on a distributed ledger or similar information repository; and

(e) purports to maintain a stable value with reference to—

(i) a single asset; or

(ii) a pool or basket of assets.”

“However, a digital representation of value is not a stablecoin if—

(a) it is issued by—

(i) a central bank;

(ii) an entity that performs the functions of a central bank;

(iii) an entity authorised by a central bank on the central bank’s behalf;

(iv) a government of a jurisdiction; or

(v) an entity authorised by a government of a jurisdiction that is acting in accordance with an authority to issue currency in that jurisdiction;”

“(b) it is a limited purpose digital token as defined by section 53ZR of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615);

(c) it constitutes securities, or a futures contract, as defined by section 1 of Part 1 of Schedule 1 to the Securities and Futures Ordinance (Cap. 571);

(d) it constitutes a float, or an SVF deposit, as defined by section 2 of the Payment Systems and Stored Value Facilities Ordinance (Cap. 584); or

(e) it constitutes a deposit as defined by section 2(1) of the Banking Ordinance (Cap. 155)”

A stablecoin is any cryptographically secured digital token used for payments, debts, or investment, that runs on a blockchain or distributed ledger, and is meant to keep its value steady against an asset (like gold) or a basket of assets.

It does not include government or central bank issued money, limited-purpose tokens (e.g. loyalty points), regulated securities, stored-value facilities, or bank deposits in Hong Kong or other jurisdictions.

What is a “specified stablecoin” as per Hong Kong Stablecoin Ordinance?

Section 4 of the Stablecoins Ordinance) defines Specified Stablecoin as:

“For the purposes of this Ordinance, a specified stablecoin is—

(a) a stablecoin that purports to maintain a stable value with reference wholly to—

(i) one or more official currencies;

(ii) one or more units of account or stores of economic value specified under subsection (2)(a); or

(iii) a combination of one or more official currencies and one or more units of account or stores of economic value specified under that subsection; or

(b) a digital representation of value, or a digital representation of value of a class, specified under subsection (2)(b).”

Unit of Account and Official Currency

“(2) The Monetary Authority may, by notice published in the Gazette, do either or both of the following—

(a) specify a unit of account or store of economic value for the purposes of subsection (1)(a)(ii);

(b) specify a digital representation of value, or class of digital representations of value, for the purposes of subsection (1)(b).”

“(3) In this section— official currency, in relation to a jurisdiction, means the currency issued by the government, the central bank, the monetary authority, or an authorised note-issuing bank of that jurisdiction.”

A specified stablecoin is a regulated category of stablecoin. It must be pegged to one or more official currencies (like the Hong Kong dollar, US dollar, euro, yen), or to other units of account that the Hong Kong Monetary Authority designates. It may also include classes of digital value that the Authority declares by Gazette notice.

This definition ensures that only currency-referenced stablecoins or formally designated tokens fall within the strict regulatory perimeter.

A specified stablecoin is a regulated category of stablecoin. It must be pegged to one or more official currencies (like the Hong Kong dollar, US dollar, euro, yen), or to other units of account that the Hong Kong Monetary Authority designates. It may also include classes of digital value that the Authority declares by Gazette notice.

This definition ensures that only currency-referenced stablecoins or formally designated tokens fall within the strict regulatory perimeter.

What is the primary purpose of the HKMA’s Guideline on stablecoins?

The primary purpose is to establish a comprehensive regulatory framework for entities that issue stablecoins referenced to fiat currencies.

“… provides a detailed overview of the ‘Guideline on Supervision of Licensed Stablecoin Issuers’ issued by the Hong Kong Monetary Authority (HKMA). The primary objectives of this framework are to safeguard monetary and financial stability, ensure robust user protection, and provide clear regulatory standards for the sustainable development of the stablecoin market in Hong Kong” (Handbook, Executive Summary, referencing HKMA Guideline).

Who needs to be licensed under this HKMA framework?

Any entity issuing a fiat-referenced stablecoin in Hong Kong, or actively marketing such a stablecoin to the Hong Kong public, must be licensed by the HKMA.

“Any entity issuing a fiat-referenced stablecoin in Hong Kong, or actively marketing such a stablecoin to the Hong Kong public, must be licensed by the HKMA” (Handbook, Executive Summary, Pillar 1: Mandatory Licensing Regime).

This clarifies the jurisdictional scope of the regulation. It covers not only issuers physically based in Hong Kong but also those based elsewhere who are targeting the Hong Kong market. This broad reach aims to prevent regulatory arbitrage, ensuring that all stablecoins circulating within or actively promoted to Hong Kong fall under the HKMA’s oversight, thereby providing consistent consumer protection and risk management.

What is the most critical requirement imposed by Hong Kong Regulators regarding the backing of stablecoins?

Stablecoins issued in Hong Kong must be “fully backed by a reserve of high-quality and highly liquid assets” at all times.

“The cornerstone of the Guideline is the requirement that stablecoins must be ‘fully backed by a reserve of high-quality and highly liquid assets’ at all times. The market value of these reserves must be at least equal to the par value of the stablecoins in circulation” (Handbook, Executive Summary, Pillar 2: Full Backing of Reserve Assets).

Full backing with high-quality, liquid assets is designed to ensure that stablecoin holders can always redeem their stablecoins at their par value, even in times of market stress. This requirement directly addresses the historical volatility concerns associated with some crypto-assets and aims to instill confidence in the stablecoin’s stability and reliability as a medium of exchange or store of value.

It also means the issuer cannot lend out the reserve assets for profit in a way that risks their liquidity or value.

What kind of protection does the HKMA Stablecoin Guideline offer to users?

The Guideline safeguards user protection, by ensuring that stablecoin holders have the fundamental right to redeem their stablecoins at par value on a timely basis. It also mandates transparency and clear disclosure.

“The framework places significant emphasis on protecting users. A key provision is the right of stablecoin holders to ‘redeem the FRS in circulation at par value on a timely basis’. This right must be clearly communicated and executed without unreasonable barriers” (Handbook, Executive Summary, Pillar 4: User Protection and Redemption Rights).

This provision aims to prevent situations where users might be unable to convert their stablecoins back into fiat currency, or where they might suffer losses due to redemption delays or discounts. Coupled with transparency requirements (like white papers and public attestations), this ensures users have access to critical information and a clear pathway to liquidate their holdings, thereby building trust and reducing systemic risk.

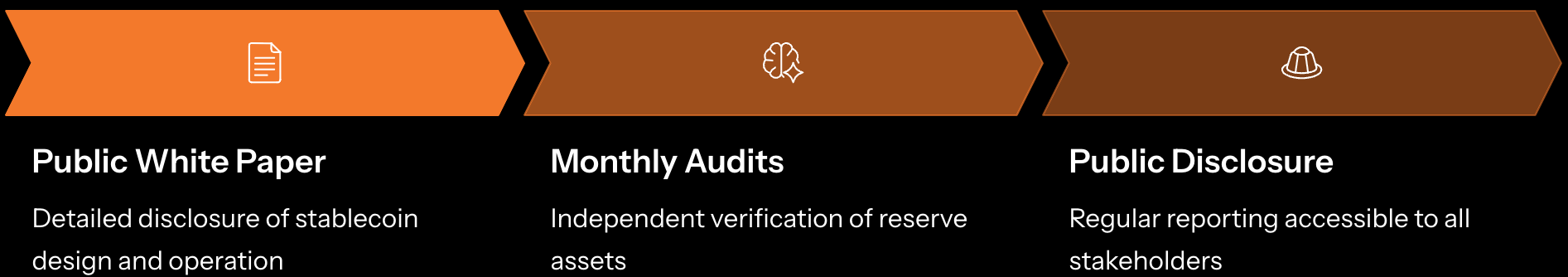

How does the HKMA Stablecoin Guideline ensure transparency in stablecoin operations?

Licensed Stablecoin issuers must provide a high degree of transparency by publishing a detailed public white paper for each stablecoin and by providing monthly, independently audited reports on their reserve assets.

“Licensed issuers must provide a high degree of transparency. This includes publishing a detailed public white paper for each stablecoin and providing monthly, independently audited reports on the reserve assets” (Handbook, Executive Summary, Pillar 5: Transparency and Disclosure).

Transparency is vital for market confidence and regulatory oversight. The white paper ensures that potential users understand the stablecoin’s design, risks, and the issuer’s operations before they engage. The requirement for monthly, independently audited reports on reserve assets provides ongoing, verifiable proof that the stablecoin remains fully backed. This regular, third-party verification minimizes the risk of misrepresentation or fraud regarding the backing assets, offering an external validation of the issuer’s financial integrity.

What is the fundamental requirement for stablecoin backing under the HKMA Stablecoin Guideline?

The HKMA Stablecoin Guideline mandates that the market value of reserve assets must, at all times, equal or exceed the par value of all outstanding stablecoins, including any restricted ones.

“The market value of reserve assets must always equal or exceed the par value of outstanding stablecoins” and “all stablecoins, even restricted ones, must be fully backed” (Handbook, Section 2.1: The Full Backing Mandate, referencing Guideline, Section 1).

This “full backing mandate” is the cornerstone of the HKMA’s approach, designed to ensure liquidity and confidence. It means that for every stablecoin issued, there must be at least an equivalent value of high-quality assets held in reserve. This prevents fractional reserve practices that could lead to a stablecoin losing its peg during periods of high redemption demand. The inclusion of “restricted ones” emphasizes that no stablecoin under the licensee’s issuance is exempt from this strict backing requirement.

What types of assets are considered “high-quality and highly liquid” for stablecoin reserves in Hong Kong?

Reserve assets must be high-quality, highly liquid, and have minimal investment risks. Eligible assets include cash and short-term bank deposits, specific marketable debt securities, cash from overnight reverse repurchase agreements, and dedicated investment funds composed solely of these eligible assets.

“Reserve assets must be ‘high-quality, highly liquid, and have minimal investment risks’. Eligible Assets Include: Cash and short-term bank deposits. Specific marketable debt securities. Cash from overnight reverse repurchase agreements. Dedicated investment funds composed solely of the above assets” (Handbook, Section 2.2: Quality, Composition, and Currency of Reserve Assets, referencing Guideline, Section 1).

Cash & Bank Deposits

Immediately available funds in regulated financial institutions

Overnight Reverse Repos

Short-term secured lending arrangements with minimal risk

Marketable Debt Securities

High-grade bonds that can be quickly sold in liquid markets

Dedicated Investment Funds

Funds composed exclusively of the above eligible assets

The HKMA limits the types of assets permitted in the reserve to those that are extremely safe and easily convertible into cash without significant loss of value. This conservative approach aims to minimize market risk, credit risk, and liquidity risk within the reserve portfolio. By restricting assets to those with “minimal investment risks,” the Guideline ensures that the stablecoin’s value remains stable and the reserve can meet redemption demands even during financial market turmoil.

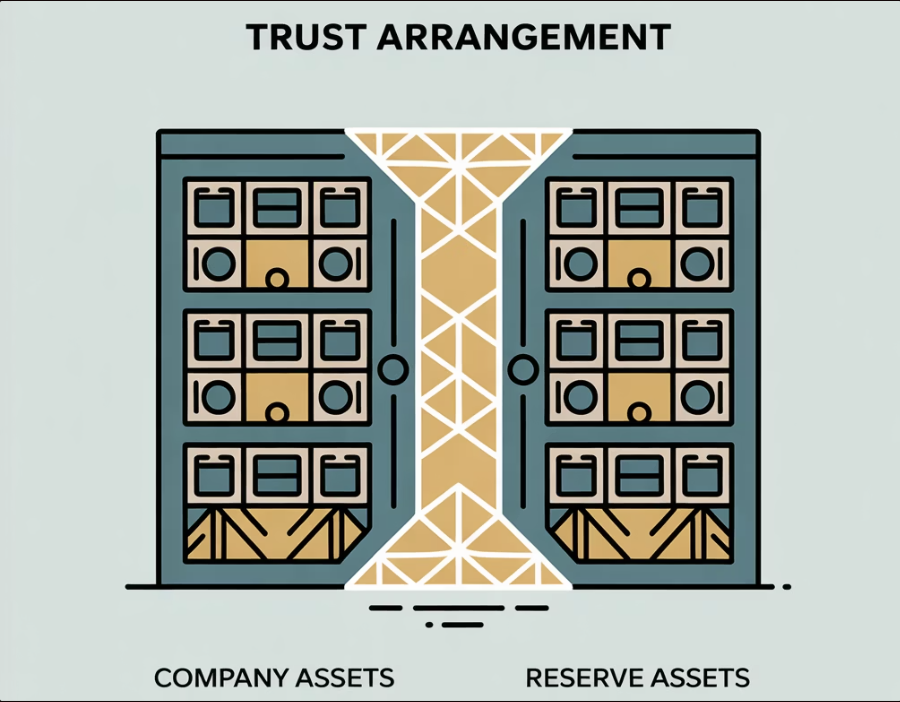

How are reserve assets in Hong Kong are legally protected from the stablecoin issuer’s own business risks or bankruptcy?

Reserve assets must be legally segregated from the licensee’s other assets through an effective trust arrangement and held separate from other funds, protected from creditors’ claims. They must also be held by qualified custodians.

“Reserve assets must be segregated from other assets of the licensee, protected from creditors’ claims, and held separate from other funds… achieved through an effective trust arrangement… Custody: Qualified custodians (licensed banks or HKMA-acceptable custodians)” (Handbook, Section 2.3: Segregation and Professional Safekeeping, referencing Guideline, Section 1).

This requirement is crucial for “bankruptcy remoteness.” By legally segregating the reserve assets via a trust, the Guideline ensures that if the stablecoin issuer faces financial distress or even bankruptcy, its creditors cannot claim the stablecoin holders’ assets.

The use of qualified, regulated custodians further enhances this protection by entrusting the safekeeping of these critical assets to independent, regulated financial institutions, adding another layer of security and oversight.

Can a stablecoin issuer in Hong Kong pay interest or offer other returns to stablecoin holders from the reserve assets?

No, licensees are expressly prohibited from paying interest or interest-like incentives on stablecoins.

“‘Licensees must not pay interest or interest-like incentives on stablecoins'” (Handbook, Section 2.4: Prohibition of Interest Payments, referencing Guideline, Section 1).

Key Point: This prohibition clearly differentiates stablecoins from interest-bearing investment products and reinforces their role as payment instruments rather than investment vehicles.

This prohibition is intended to clearly differentiate stablecoins from traditional bank deposits or other interest-bearing investment products. It reinforces the stablecoin’s primary role as a payment instrument or store of value, rather than an investment vehicle designed to generate returns. This also ensures that the reserve assets are not subjected to additional risks by being used to generate yield, thereby maintaining their full backing and liquidity. The income from reserve assets belongs to the licensee, but this cannot be passed on to stablecoin holders as interest.

What are the key disclosure requirements for reserve assets for Stablecoin issuance in Hong Kong?

Licensees must provide daily statements (on request), weekly public reporting on their website, and crucial monthly independent attestations by qualified auditors. Any breaches or discrepancies must be reported to the HKMA immediately.

“Reporting Frequency: Daily… Weekly… Monthly: ‘Regular independent attestations by qualified auditors are mandatory… submitted to HKMA monthly and disclosed publicly’. Immediate Notification: ‘breaches or discrepancies… to the HKMA immediately'” (Handbook, Section 2.5: Stringent Disclosure, Reporting, and Attestation, referencing Guideline, Section 1).

Transparency and independent verification are paramount for public confidence. The multi-tiered reporting structure (daily internally, weekly publicly, monthly externally audited) provides continuous oversight of the reserve assets’ status. The requirement for independent auditor attestations is particularly important as it offers an objective, third-party validation of the issuer’s claims about its reserves, significantly reducing the risk of misrepresentation or fraud. Immediate notification of issues further ensures that the HKMA can intervene promptly if any problems with backing or compliance arise.

How can a Hong Kong licensed stablecoin issuer create (mint) new stablecoins?

In Hong Kong, new stablecoins can only be issued after a valid customer request and upon the licensee’s receipt of corresponding funds in the referenced fiat currency.

“Stablecoins can only be issued after a valid customer request and upon the licensee’s ‘receipt of funds in the referenced currency'” (Handbook, Section 3.1: The Issuance Process: Controlled Creation, referencing Guideline, Section 2).

This rule enforces a strict “1:1” relationship between incoming fiat currency and newly minted stablecoins. It prevents the arbitrary creation of stablecoins, ensuring that every unit in circulation is directly backed by real money held in the reserve. This controlled creation mechanism is fundamental to maintaining the stablecoin’s peg and preventing inflationary practices that could destabilize its value.

What is the right of a stablecoin holder regarding their holdings and redemption in Hong Kong?

Every stablecoin holder has the fundamental right to redeem their stablecoins at par value.

“The framework emphatically states that ‘Holders have the right to redeem stablecoins at par value'” (Handbook, Section 3.2: The Right to Redemption: Guaranteeing Liquidity, referencing Guideline, Section 2).

Par Value Redemption: This means that one unit of a fiat-referenced stablecoin must always be convertible into one unit of the underlying fiat currency without any discount or premium.

This is a crucial user protection feature. It means that one unit of a fiat-referenced stablecoin must always be convertible into one unit of the underlying fiat currency without any discount or premium, effectively guaranteeing its liquidity and stability. This right is critical for stablecoins to function reliably as a means of payment or store of value, assuring users that their digital holdings can always be exchanged for the underlying fiat.

How quickly must redemption requests be processed for a stablecoin as per HK Stablecoin Ordinance and HKMA Guidelines?

Redemption requests must typically be processed promptly, generally within one business day, unless a different timeframe has been explicitly approved by the HKMA.

“Redemption requests must be processed promptly, typically ‘within one business day’, unless a different timeframe is approved by the HKMA” (Handbook, Section 3.2: The Right to Redemption: Guaranteeing Liquidity, referencing Guideline, Section 2).

1

Business Day

Standard timeframe for processing redemption requests

This requirement ensures that stablecoin holders can quickly access their underlying fiat currency, enhancing the stablecoin’s utility and trustworthiness. Delays in redemption can erode confidence and hinder the stablecoin’s use in real-world transactions. The strict timeframe minimizes liquidity risk for users and promotes efficient market operations.

As per HK Stablecoin Ordinance and HKMA Guidelines, what happens to reserve assets if a stablecoin issuer becomes insolvent?

In an insolvency scenario, stablecoin holders have a direct claim on the segregated reserve assets, facilitating their redemptions.

“In an insolvency scenario, holders have a direct claim on the segregated reserve assets to facilitate their redemptions” (Handbook, Section 3.2: The Right to Redemption: Guaranteeing Liquidity, referencing Guideline, Section 2).

This is a vital consumer protection measure. By ensuring that reserve assets are legally separated and that stablecoin holders have a direct claim on them, the Guideline aims to make stablecoin holders “bankruptcy remote.” This means that the failure of the issuing company itself should not prevent stablecoin holders from recovering their funds, as the assets backing their stablecoins are protected from the general creditors of the insolvent issuer.

What are a Hong Kong Stablecoin licensee’s responsibilities when using third parties for stablecoin distribution?

If a licensee uses third parties (e.g., exchanges, wallet providers) for distribution, the licensee remains fully responsible for compliance and must conduct thorough due diligence on these partners to ensure they are reputable and operate in a sound manner.

“If a licensee uses third parties (e.g., exchanges, wallet providers) for distribution, the licensee remains responsible. It must conduct thorough due diligence on these partners to ensure they are reputable and operate in a sound manner” (Handbook, Section 3.3: Distribution Channels and Third-Party Oversight).

This establishes the “ultimate responsibility” principle. Even when outsourcing aspects of their operations, licensees cannot outsource their regulatory obligations. This requirement forces issuers to carefully vet their partners and continuously monitor their activities, extending the reach of regulatory oversight and ensuring that the entire stablecoin ecosystem operates to high standards, regardless of which entities are directly interacting with the end-user.

What are the KYC and AML/CTF obligations for licensees during customer onboarding?

Licensees must implement robust customer due diligence (CDD) and Know Your Customer (KYC) policies in line with Hong Kong’s Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CTF) guidelines. They must also take active measures to prevent offering services in jurisdictions where it would be unlawful.

“Licensees must implement robust customer due diligence (CDD) and Know Your Customer (KYC) policies in line with Hong Kong’s Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CTF) guidelines. They must also take active measures, such as IP blocking and identity verification, to prevent offering services in jurisdictions where it would be unlawful” (Handbook, Section 3.4: Customer Onboarding: KYC and AML/CTF Compliance).

Customer Due Diligence

Thorough verification of customer identity and risk assessment

Jurisdictional Compliance

Active measures to prevent service in prohibited locations

Risk Monitoring

Ongoing surveillance for suspicious transactions

This provision integrates stablecoin issuers into the broader financial system’s efforts to combat financial crime. By mandating strict KYC/AML/CTF procedures, the HKMA aims to prevent stablecoins from being used for illicit activities like money laundering or terrorist financing. The additional requirement for geographical restrictions through measures like IP blocking underscores the HKMA’s commitment to ensuring global regulatory compliance and preventing stablecoins issued under its regime from being exploited in jurisdictions with less stringent oversight.

What is the minimum capital requirement for a licensed stablecoin issuer?

For licensees that are not authorized institutions (e.g., banks), they must maintain at least HK$25,000,000 (or equivalent) in paid-up share capital.

“For licensees (excluding authorized institutions)… must maintain ‘at least HK$25,000,000 (or equivalent) in paid-up share capital'” (Handbook, Section 4.1: Minimum Capital Requirements, referencing Guideline, Section 4).

HK$25M

Minimum Capital

Required paid-up share capital for non-bank stablecoin issuers

This capital requirement is distinct from the stablecoin reserve assets and serves as a financial buffer for the operating entity itself. It ensures the issuer has sufficient financial resources to absorb operational losses, fund its ongoing expenses, and invest in necessary infrastructure without jeopardizing the stablecoin’s backing assets. It acts as a prudential safeguard, ensuring the issuer’s financial stability and its ability to continue operations even during periods of stress, thereby protecting the overall integrity of the stablecoin service.

Why does the HKMA impose minimum capital requirements on stablecoin issuers?

The capital serves as a buffer to absorb potential losses, fund ongoing operational expenses, and ensure the issuer’s capacity to conduct an orderly wind-down if required, without impacting stablecoin holders.

“This capital serves as a buffer to absorb losses and fund operations without touching the reserve assets” and “ensuring it has a secure and stable source of funding” (Handbook, Section 4.1: Minimum Capital Requirements).

The HKMA’s rationale is to ensure the long-term viability and resilience of the stablecoin issuer as a business entity. By requiring significant capital, the HKMA mitigates the risk that operational or business failures of the issuer could spill over and affect the stablecoin’s ability to maintain its peg or allow for redemptions. It also provides resources for a controlled exit from the market, protecting users and the broader financial system from abrupt disruptions.

Can a Hong Kong licensed stablecoin issuer engage in other business activities?

Generally, a licensee cannot engage in other business activities without explicit prior consent from the HKMA. Any approved “Other Business Activities” must not pose significant risks or create conflicts of interest.

“A licensee cannot engage in other business activities without prior consent from the HKMA. Any approved ‘Other Business Activities’ must not pose significant risks to the stablecoin issuance operations or create conflicts of interest” (Handbook, Section 4.2: Restrictions on Other Business Activities).

This restriction aims to keep the licensed entity focused primarily on its core stablecoin issuance business. By requiring prior consent, the HKMA can assess potential new activities for their risk profile and determine if they might divert resources, introduce undue complexity, or create conflicts of interest that could compromise the stablecoin’s stability or the protection of its holders. This approach limits scope creep and ensures the integrity of the regulated activity.

What is the purpose of restricting other business activities for licensees in Hong Kong?

The purpose is to maintain focus on the core stablecoin business, mitigate potential conflicts of interest, and prevent undue risks that could jeopardize the stablecoin issuance operations or the protection of stablecoin holders.

“This ensures that the licensee’s core business must always remain the secure issuance and management of stablecoins… to ensure they do not introduce undue risks or dilute the issuer’s focus on its primary, regulated function” (Handbook, Section 4.2: Restrictions on Other Business Activities).

This rule underscores the HKMA’s prudential approach. It seeks to prevent the stablecoin entity from engaging in speculative or unrelated ventures that could deplete its capital, introduce unmanageable risks, or create situations where the interests of the stablecoin business conflict with other commercial interests. By maintaining a narrow focus, the HKMA aims to ensure that the licensee’s resources and attention are primarily dedicated to ensuring the safety and stability of the stablecoin.

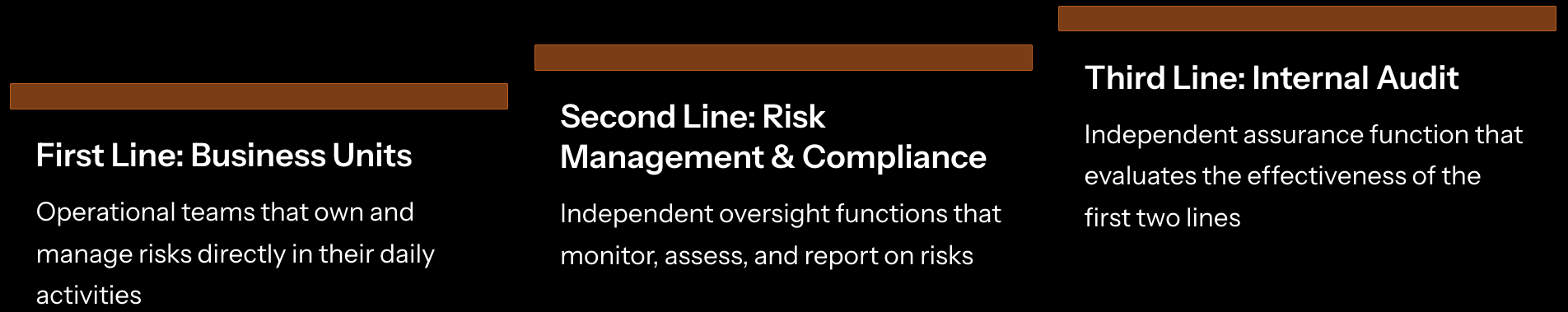

What is the “three-lines-of-defence” model required by the HKMA for risk management of Stablecoin?

The “three-lines-of-defence” model assigns distinct roles: business units (first line) own and manage risk; independent risk management and compliance functions (second line) oversee risk; and an independent internal audit function (third line) provides objective assurance.

“The Guideline promotes a ‘three-lines-of-defence’ model… First Line: Business units… Second Line: Independent risk management and compliance functions… Third Line: An independent internal audit function” (Handbook, Section 5.1: The Three Lines of Defence Model).

This model establishes clear responsibilities for risk ownership, oversight, and independent assurance. It’s designed to ensure that risks are identified and managed at every level of the organization, with built-in checks and balances. This layered approach helps to prevent control failures, promotes a strong risk culture, and provides the Board and senior management with reliable information about the effectiveness of their risk management framework.

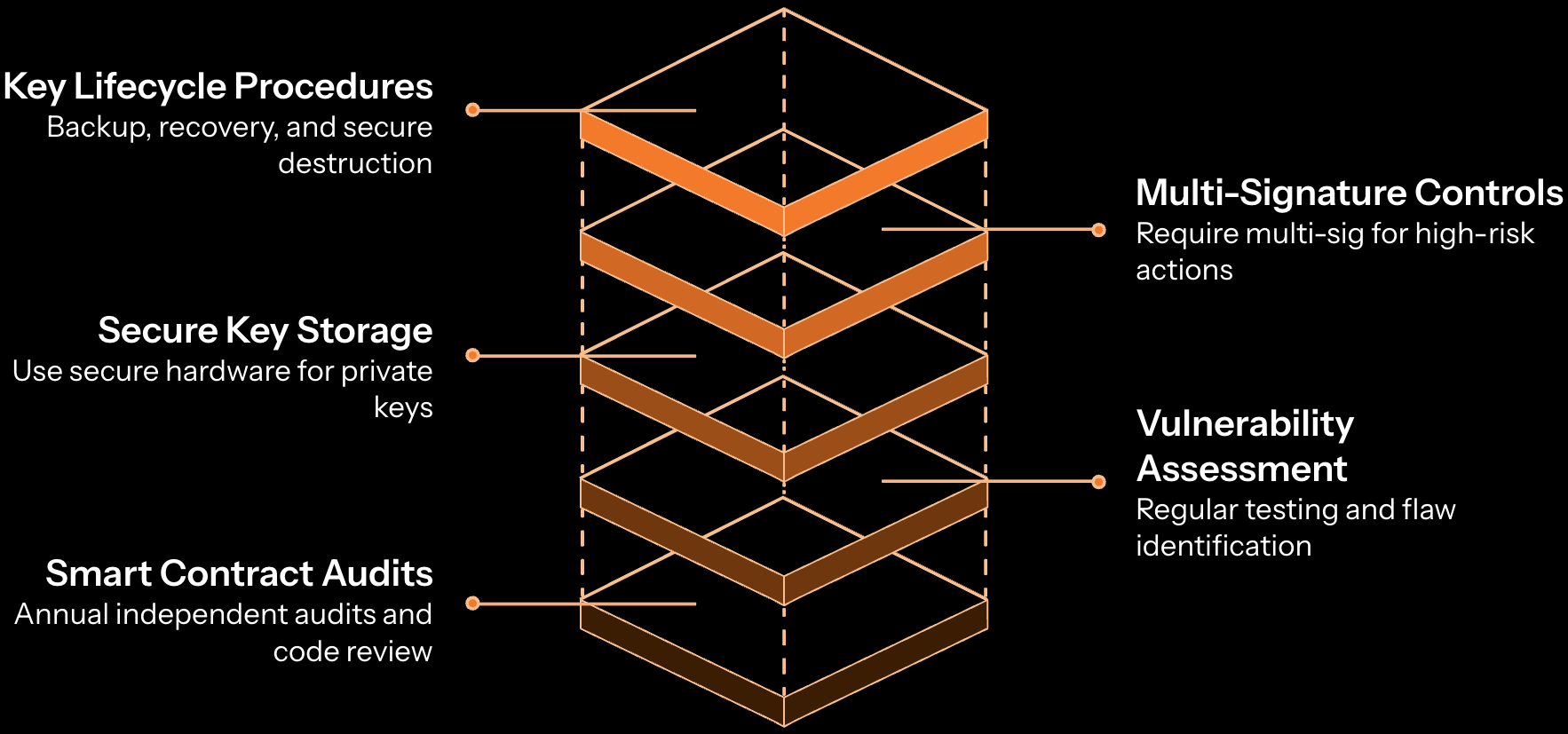

As per HK Stablecoin Ordinance and HKMA Guidelines, what specific cybersecurity measures are mandated for stablecoin issuers, especially concerning smart contracts and private keys?

Licensees must ensure smart contracts undergo “annual smart contract audits” by independent parties. For private keys, requirements include secure hardware, multi-signature protocols for high-risk operations, strict access controls, and robust procedures for key backup, recovery, and destruction.

“Smart Contract Security… smart contracts must undergo ‘annual smart contract audits’ by a qualified independent party… Wallet and Private Key Management… using secure hardware, multi-signature protocols for high-risk operations, strict access controls, and robust procedures for key backup, recovery, and destruction” (Handbook, Section 5.2: Technology and Cybersecurity Risk).

Smart Contract Security

- Annual independent audits

- Vulnerability assessment

- Code review by qualified experts

Private Key Management

- Secure hardware storage

- Multi-signature protocols

- Strict access controls

- Robust backup and recovery

Given the digital nature and potential for large-scale financial impact, technology and cybersecurity risks are critically important. Smart contract audits are essential to identify coding errors or vulnerabilities that could be exploited, leading to loss of funds or de-pegging events. The stringent private key management rules are designed to prevent unauthorized access and theft, as private keys are the ultimate control mechanism for stablecoin operations and reserve assets. These measures aim to build trust in the technical infrastructure underpinning the stablecoin.

How does the HKMA ensure an orderly wind-down if a licensed stablecoin issuer ceases operations?

Every Hong Kong Stablecoin licensee is required to have a pre-prepared “plan for orderly wind-down of licensed stablecoin activities” to protect stablecoin holders’ interests and ensure a smooth market exit.

“A critical, forward-looking requirement is for every licensee to have a pre-prepared ‘plan for orderly wind-down of licensed stablecoin activities’… It must detail how stablecoins will be redeemed, how reserve assets will be managed during the wind-down, and how users will be informed” (Handbook, Section 5.3: Operational Risk and Business Continuity).

This requirement anticipates potential failures and aims to mitigate their impact. An orderly wind-down plan ensures that even if an issuer becomes insolvent or decides to exit the market, stablecoin holders can still redeem their funds in a structured and transparent manner. This protects users from abrupt market disruptions and reduces systemic risk, reflecting a prudential approach that considers the entire lifecycle of a regulated entity. It builds confidence that even in adverse scenarios, user funds are safeguarded.

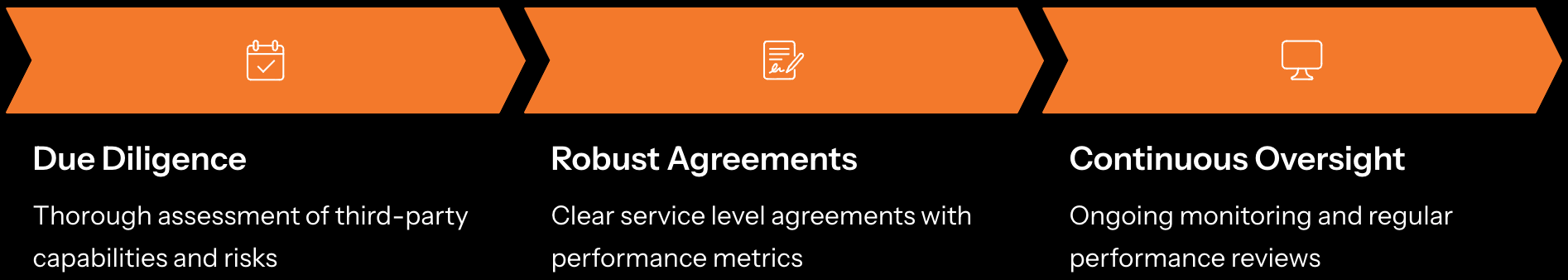

What is the licensee’s responsibility when outsourcing critical functions to third parties?

A Hong Kong Stablecoin Licensees must diligently manage risks associated with outsourcing critical functions, including thorough due diligence on service providers, robust service level agreements (SLAs), and continuous monitoring, ensuring the licensee retains appropriate oversight and control.

“Licensees must diligently manage risks associated with outsourcing critical functions, ensuring providers are competent and that the licensee retains access and control” (Handbook, Section 5.3: Operational Risk and Business Continuity).

While outsourcing can bring efficiencies, it also introduces new risks. The HKMA holds the licensee ultimately responsible for outsourced activities, meaning they cannot simply delegate away their regulatory obligations. This forces licensees to carefully select and manage their third-party providers, ensuring that these external entities also operate to the required regulatory standards, especially for critical functions that could impact the stablecoin’s stability or security. This prevents a “blind spot” in the regulatory perimeter.

What is the Board of Directors’ responsibility for a licensed stablecoin issuer in Hong Kong?

The Board of Directors holds the responsibility for setting the strategic direction, overseeing management, and ensuring compliance with all regulatory requirements, including prudent management of the business in the interests of stablecoin holders and overall financial stability.

“The Board of Directors holds ultimate responsibility. It must be composed of qualified individuals… Senior management is accountable to the Board for implementing strategy and managing day-to-day operations” (Handbook, Section 6.1: Board of Directors and Senior Management Responsibilities).

The HKMA places the ultimate accountability squarely on the Board. This means that while day-to-day tasks are delegated, the Board is responsible for establishing a robust governance framework, overseeing its implementation, and ensuring that the company operates in a sound, ethical, and compliant manner. This top-down accountability is critical for fostering a strong risk culture and ensuring that the interests of stablecoin holders are prioritized.

As per Hong Kong Stablecoin Ordinance, what does “fitness and propriety” mean for key personnel, and why is it important?

“Fitness and propriety” means that all key personnel, including directors, senior managers, and major controllers, must be assessed as suitable for their roles based on their reputation, knowledge, experience, and financial soundness. It’s important for maintaining public trust and ensuring sound management.

“All key personnel… must be ‘fit and proper’ for their roles… The HKMA assesses this based on their reputation, knowledge, experience, and financial soundness” (Handbook, Section 6.2: Fitness and Propriety Requirements, referencing Guideline, Section 7).

Reputation

Personal and professional integrity, ethical conduct, and regulatory history

Experience

Relevant professional background and track record in similar roles

Knowledge

Relevant education, training, and understanding of regulatory requirements

Financial Soundness

Personal financial stability and absence of concerning financial history

This requirement is designed to ensure that the leadership and key decision-makers of a stablecoin issuer are individuals of integrity and competence. By vetting their character, qualifications, and financial history, the HKMA aims to prevent individuals with questionable backgrounds or insufficient expertise from holding positions of influence. This pre-emptive measure is vital for safeguarding the stablecoin’s operations, protecting users, and upholding the reputation of Hong Kong as a regulated financial center.

How does the HKMA ensure independence for compliance and internal audit functions?

The compliance and internal audit functions must be independent, adequately resourced, and have direct reporting lines to the Board or a relevant committee to ensure their objectivity is not compromised.

“The compliance and internal audit functions must be independent, adequately resourced, and have direct reporting lines to the Board or a relevant committee to ensure their objectivity is not compromised” (Handbook, Section 6.3: Independent Functions: Compliance and Internal Audit).

Independence is paramount for these oversight functions. If compliance and internal audit report solely to operational management, their objectivity can be compromised, and issues might be suppressed.

By requiring direct reporting lines to the Board or its committees, the HKMA ensures that these functions can perform their duties without fear of reprisal and that critical findings are escalated to the highest levels of governance, enabling timely and appropriate action. This strengthens internal controls and reduces the risk of regulatory breaches.

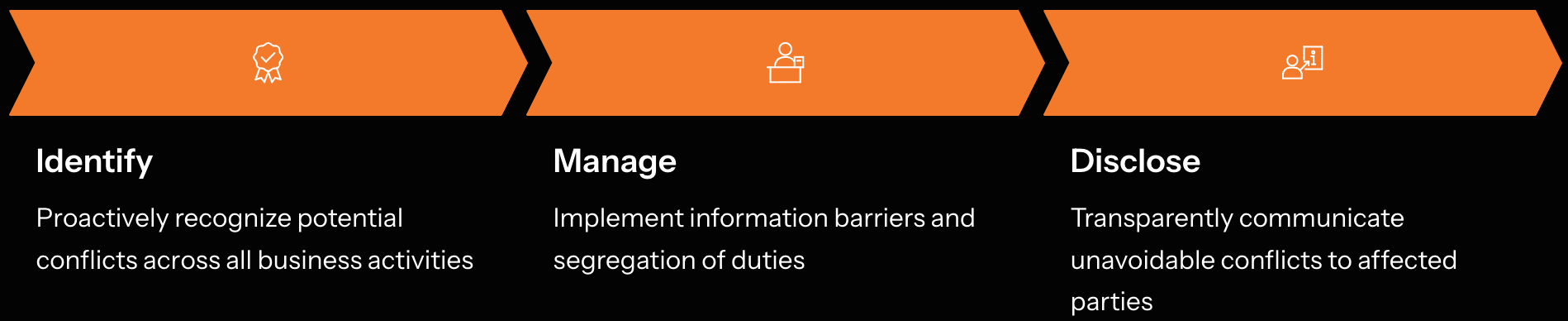

What measures must a Hong Kong Stablecoin licensee implement to manage conflicts of interest?

A Hong Kong StablecoinLicensees must establish clear measures, such as information barriers and segregation of duties, to identify, manage, and disclose any potential conflicts of interest.

“Licensees must establish clear measures, such as information barriers and segregation of duties, to identify, manage, and disclose any potential conflicts of interest” (Handbook, Section 6.4: Conflicts of Interest Management).

Conflicts of interest can arise when an individual or entity has competing interests that could influence their decision-making, potentially leading to unfair advantages or harm to clients. In the stablecoin context, this could involve the issuer’s interests conflicting with those of stablecoin holders or the integrity of the market. Measures like “Chinese Walls” (information barriers) prevent sensitive information from being shared inappropriately, while segregation of duties ensures that no single individual controls multiple critical steps in a process, thereby reducing the opportunity for impropriety and protecting the interests of stablecoin holders.

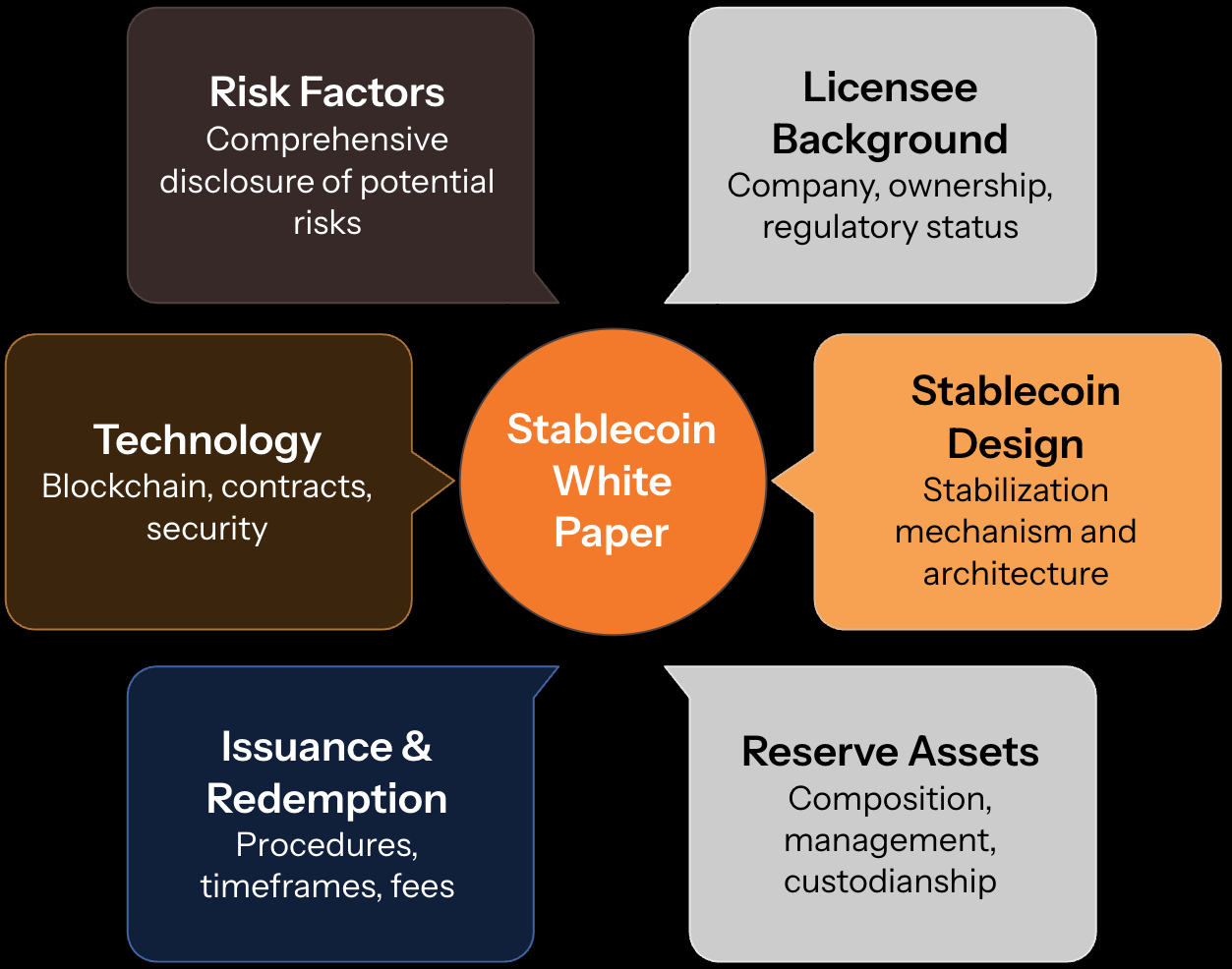

What is a Stablecoin “Public White Paper,” and what information must it contain as per HKMA Stablecoin guideline?

A Stablecoin Public White Paper is a detailed document that licensees must publish on their website for each type of stablecoin issued. It must be written in non-technical language and include comprehensive information on the licensee’s background, the stablecoin’s design and stabilization mechanism, reserve asset arrangements, issuance/redemption procedures, underlying technology, and all associated risks.

“For each type of stablecoin issued, the licensee must publish a detailed white paper on its website. This document must be written in non-technical language and include comprehensive information on: The licensee’s background. The stablecoin’s design and stabilization mechanism. The detailed arrangements for reserve assets. The rights and procedures for issuance and redemption. The underlying technology and all associated risks” (Handbook, Section 7.1: Comprehensive Information Disclosure).

Conflicts of interest can arise when an individual or entity has competing interests that could influence their decision-making, potentially leading to unfair advantages or harm to clients. In the stablecoin context, this could involve the issuer’s interests conflicting with those of stablecoin holders or the integrity of the market. Measures like “Chinese Walls” (information barriers) prevent sensitive information from being shared inappropriately, while segregation of duties ensures that no single individual controls multiple critical steps in a process, thereby reducing the opportunity for impropriety and protecting the interests of stablecoin holders.

How does the Stablecoin Guideline ensure the protection of users’ personal data?

All licensees must comply with the Personal Data (Privacy) Ordinance (PDPO) to ensure the protection of customer data. This includes secure storage, transmission, disposal of personal data, and robust access controls.

“All licensees must comply with the Personal Data (Privacy) Ordinance (PDPO) to ensure the protection of customer data” (Handbook, Section 7.3: Personal Data Protection).

Protecting sensitive personal data is paramount in today’s digital landscape. By mandating compliance with the PDPO, the HKMA puts a mandate on stablecoin issuers to handle customer information responsibly, minimizing the risk of data breaches, misuse, or unauthorized access. This aligns the stablecoin regulatory framework with broader privacy laws, reinforcing user trust and mitigating reputational and legal risks for the licensees. It also covers secure data handling practices even if data is processed or stored internationally.

What is the role of independent attestations in public disclosure for a stablecoin issuer in Hong Kong?

For a Hong Kong Stablecoin Licensees, Independent attestations, prepared by qualified auditors and published monthly, are crucial for verifying the issuer’s claims about its reserve assets, providing objective, third-party validation to the public.

“Regular independent attestations by qualified auditors are mandatory… submitted to HKMA monthly and disclosed publicly” (Guideline, Section 1, as referenced in Handbook, Section 2.5 and 7.1).

Independent attestations provide a critical layer of assurance beyond the issuer’s own reports. They offer an unbiased, professional verification that the stablecoin’s reserves are indeed full, liquid, and composed of eligible assets as claimed.

This external validation significantly enhances transparency and credibility, building confidence among stablecoin holders and the broader market that the stablecoin is genuinely backed and managed in accordance with regulatory requirements.

What is the minimum paid-up share capital required for a HKMA licensed stablecoin issuer, and why is it important?

HKMA Licensed stablecoin issuers must maintain a minimum paid-up share capital of HK$25 million (or its equivalent in foreign currency). This capital serves as a financial buffer, ensuring the licensee can cover operational expenses during stress periods, fund orderly wind-down procedures if needed, and maintain market confidence in the stablecoin.

“Licensees must maintain at least HK$25,000,000 in paid-up share capital… to sustain operations and facilitate orderly exit” (Handbook, Section 8.1: Minimum Capital Requirements, referencing Guideline, Section 5.1).

HK$25M

Capital Buffer

Ensures operational stability and protects against business risks

This capital requirement is a prudential measure aimed at the solvency of the operating entity itself, distinct from the assets backing the stablecoin. It ensures that the issuer has sufficient non-reserve funds to absorb business losses, manage operational risks, and provide for a controlled cessation of business without impacting stablecoin holders’ funds. It signifies the HKMA’s intent for licensees to be financially robust and self-sufficient, capable of navigating adverse conditions.

How does the HKMA evaluate a HK Stablecoin licensee’s operational resilience?

The HKMA evaluates operational resilience based on the licensee’s ability to execute business plans under normal conditions, withstand shocks through liquidity stress testing and scenario planning, and ensure compliance across all relevant jurisdictions. The evaluation also considers the business model’s complexity, risk mitigation measures, potential impact on Hong Kong’s financial stability, and the effectiveness of contingency planning.

“Licensees must demonstrate capacity to: Execute business plans… Withstand shocks… Comply cross-border… The HKMA evaluates resilience based on: Business model complexity, Risk mitigation measures, Potential impact on Hong Kong’s financial stability, Contingency planning effectiveness” (Handbook, Section 8.2: Operational Resilience Standards).

Operational resilience is about an entity’s ability to prepare for, respond to, and recover from disruptions. The HKMA’s comprehensive evaluation ensures that licensees are not only compliant on paper but can actually maintain critical operations in the face of unexpected events, whether market shocks, cyberattacks, or other disruptions. This forward-looking approach helps prevent operational failures from translating into financial instability or affecting the reliable functioning of stablecoins in the market.

What kind of stress testing is expected for liquidity management as per Hong Kong Stablecoin Ordinance and HKMA Guideline?

Licensees are expected to conduct liquidity stress testing on a quarterly basis.

“Liquidity stress testing (quarterly)” (Handbook, Section 8.2: Operational Resilience Standards).

4x

Annual Testing

Quarterly liquidity stress tests required per year

Regular liquidity stress testing helps licensees understand their potential vulnerabilities under various adverse scenarios (e.g., sudden redemption spikes, market illiquidity). By conducting these tests quarterly, licensees can identify potential shortfalls in their liquid assets or weaknesses in their liquidity management strategies, allowing them to take corrective action before a crisis hits. This proactive measure is vital for maintaining the stablecoin’s peg and ensuring timely redemptions under stressful market conditions.