Understanding Tokenisation

Introduction

Tokenisation represents a fundamental shift in how we handle ownership of assets in the digital age. It refers to the process of converting ownership rights or physical assets into digital tokens that are stored and managed on a blockchain. In simple words, tokenisation is the process of creating a digital token that represents a real-world asset (tangible and intangible). These tokens are stored on a blockchain, a secure and transparent digital ledger, and can be used to divide ownership of assets into smaller, tradeable units. By transforming assets into digital tokens, tokenisation makes it easier to buy, sell, or transfer ownership, even across borders, without relying on traditional intermediaries.

Key Benefits of Tokenisation

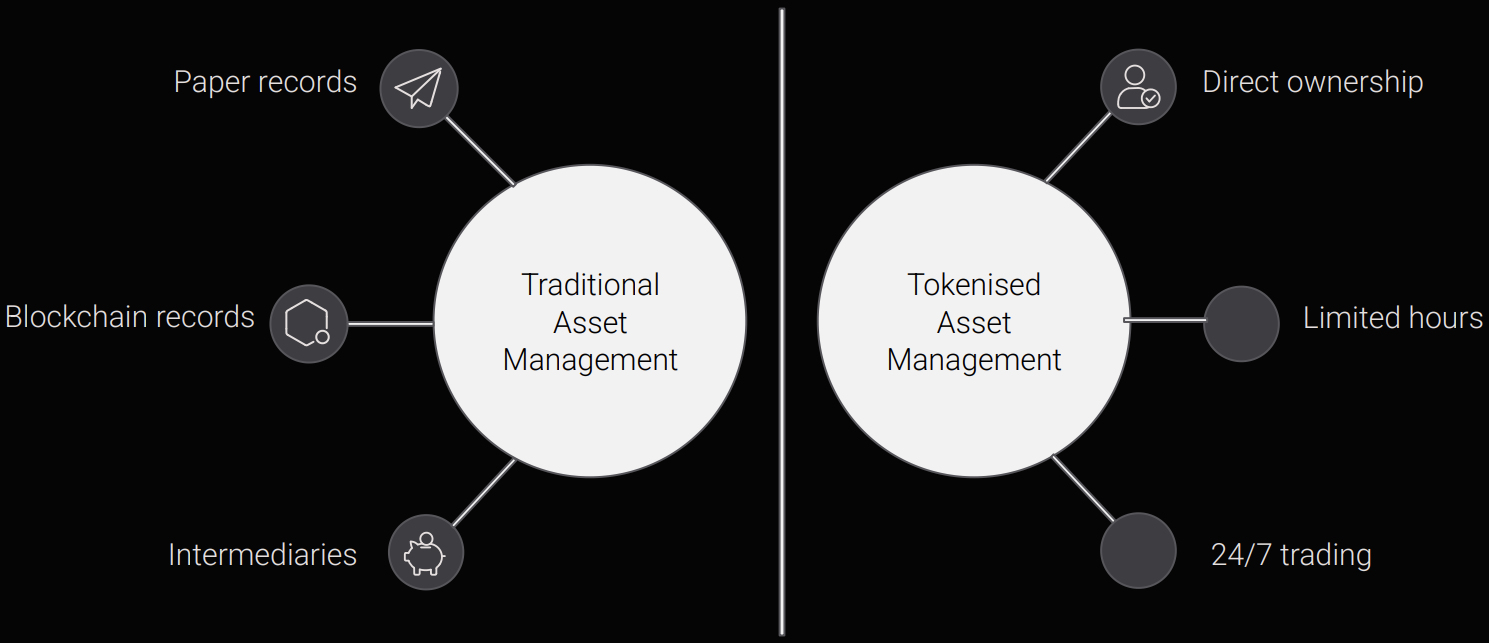

Tokenisation offers several key benefits that are transforming how assets are owned and traded. One major advantage is increased liquidity. By dividing assets into smaller, tradeable units, tokenisation allows more people to participate in the market, boosting activity and making it easier to buy or sell these assets. Another benefit is fractional ownership, which lets investors purchase small portions of high-value assets like real estate or artwork. This lowers entry barriers and opens up investment opportunities to a broader audience, making it more inclusive. Additionally, blockchain technology enhances transparency by recording all transactions in a clear and tamper-proof manner. This ensures accurate ownership records and reduces the chances of disputes, building trust among investors and participants.

Why Tokenisation Emerged

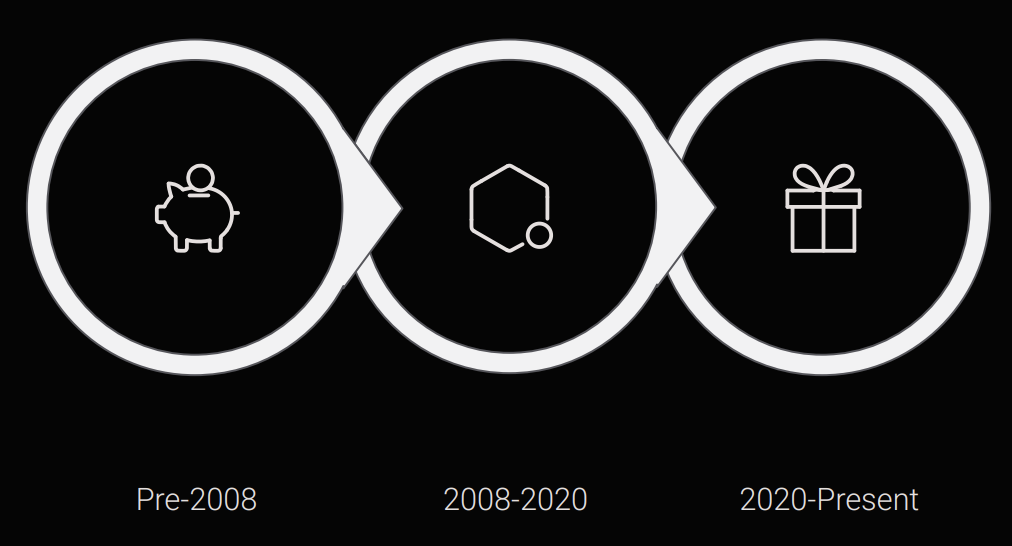

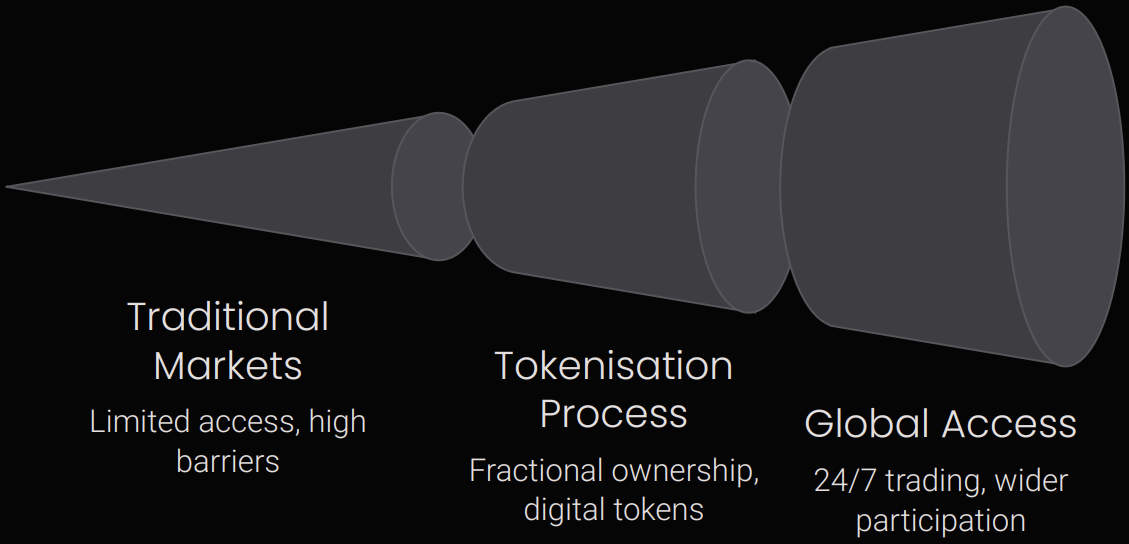

Traditional systems for owning, transferring, and verifying assets have long been burdened by inefficiencies. Paper-based records, manual verifications, and reliance on intermediaries like banks or notaries often lead to delays, high costs, and errors. Cross-border transactions, in particular, can take days or weeks due to differing legal standards and paperwork. These challenges became especially apparent in the early 2000s as global markets grew more interconnected, highlighting the need for faster, more reliable methods.

Tokenisation emerged as a response, building on the advent of blockchain and distributed ledger technologies around 2008. Blockchain, first popularized by Bitcoin, provides a decentralized way to record data across multiple computers, ensuring that no single entity controls the information. This foundational technology addressed key pain points by enabling instant verification and reducing the need for trusted third parties, paving the way for tokenisation to streamline asset management in a digital economy.

Key Characteristics

Digital Representation

Tokens are digital identifiers that represent ownership or rights to an asset. Depending on the type of asset being tokenised, tokens can either be fungible, like cryptocurrencies that are interchangeable, or non-fungible, like unique digital art pieces or collectibles.

Blockchain Storage

These tokens are stored securely on a blockchain, which acts as a transparent and tamper-proof ledger. The decentralised nature of blockchain ensures that all transactions are verifiable and highly resistant to manipulation or fraud.

Smart Contracts

Tokenisation often uses smart contracts, which are self-executing programs with the terms of the agreement written directly into code. These contracts automate processes such as transferring ownership or conducting compliance checks, making the system more efficient while reducing administrative costs.

Benefits and Promises of Tokenisation

Tokenisation brings several practical improvements to asset handling. Fractional ownership allows high-value items to be divided into smaller shares, enabling more people to invest in assets that were once out of reach, such as a luxury property or fine art. This democratizes access without altering the asset’s value. Companies like RealT, for instance, have tokenised U.S. luxury apartments, allowing investors worldwide to purchase fractional shares and earn rental income proportional to their holdings.

Transparency and auditability arise from the blockchain’s open ledger, where transactions are publicly verifiable, reducing disputes and building confidence among participants. Every change of ownership or transaction is permanently recorded and accessible, ensuring that accurate records are maintained and tamper-proof.

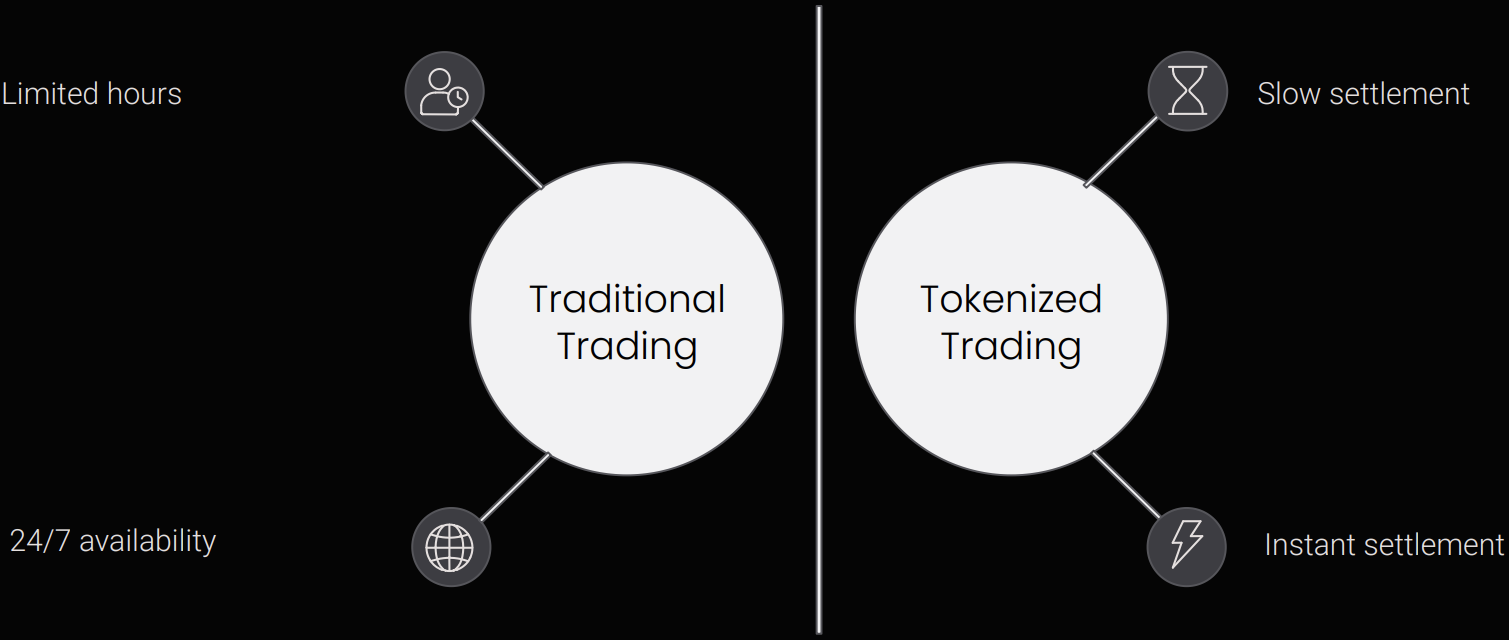

Accessibility and efficiency improve as tokens can be traded globally around the clock, bypassing geographical barriers and streamlining processes that once required multiple intermediaries. Unlike traditional markets with limited operating hours, tokenised assets can be traded 24/7, enabling faster transactions and broader participation in global markets. This leads to faster settlement times, often near-instant compared to days or even weeks in traditional systems, which cut costs and speed up liquidity, making markets more responsive.

Limitations and Challenges

While promising, tokenisation comes with considerations that warrant careful attention. Regulatory uncertainty persists in many areas, as frameworks for digital assets continue to develop, potentially affecting how tokens are issued and traded. Jurisdictions globally are still grappling with how to classify and regulate these new digital instruments, leading to a patchwork of rules rather than a unified approach.

Custody and control issues arise, including risks of losing access to digital wallets or vulnerabilities in storage systems, which require extensive security measures. While self-custody offers individuals complete control, it also places the full burden of security on them, whereas professional digital asset custodians offer institutional-grade security but introduce a new form of intermediary reliance.

Technical interoperability poses another hurdle, as different blockchains may not communicate seamlessly, complicating transfers across platforms. While efforts are underway to build bridges between various blockchain networks, a fully unified ecosystem is still a future aspiration.

Finally, market adoption barriers, such as the need for user education, integration with existing financial systems, and overcoming the inertia of traditional institutions, can slow progress. These factors highlight the importance of thoughtful implementation rather than viewing tokenisation as a complete solution, acknowledging that a paradigm shift of this magnitude requires careful navigation.

In 2025, barriers to tokenisation growth include regulatory uncertainty and technical interoperability. Major jurisdictions like Singapore, the EU, and the UAE are developing comprehensive frameworks, with cross-border harmonisation now underway. Institutional adoption is rising, but full-scale integration requires significant legal and infrastructure upgrades.

Applications of Tokenisation

Imagine owning a high-value asset like a skyscraper. Instead of requiring a single buyer to purchase the entire building, tokenisation divides ownership into digital tokens, each representing a fraction of the property. These tokens can then be traded on blockchain platforms, enabling broader participation in asset ownership.

Key Application Areas

Real Estate

Companies like RealT have tokenised U.S. luxury apartments, allowing investors to own fractional shares and earn rental income proportional to their holdings.

Art and Collectibles

High-value artworks, such as Andy Warhol paintings, have been tokenised to democratise access to the art market.

Precious Metals and Carbon Credits

Tokenised gold offers a way to invest in precious metals, while carbon credit tokens facilitate sustainability efforts.

Sports and Finance

Fans can invest in players’ future earnings, while financial institutions use tokenisation to enhance the efficiency of trading bonds and stocks.

Financial Instruments

Stocks, bonds, and other securities can be represented as tokens on a blockchain, facilitating easier trading and settlement processes, including tokenised ETFs, mutual funds, and fixed-income instruments.

Intellectual Property

Rights to intellectual property can also be tokenised, allowing creators to monetise their work more effectively while maintaining control.

- Tokenised government treasuries (largest segment)

- Private credit/loans platforms ($13B+ in tokenised loans)

- Wine/whisky

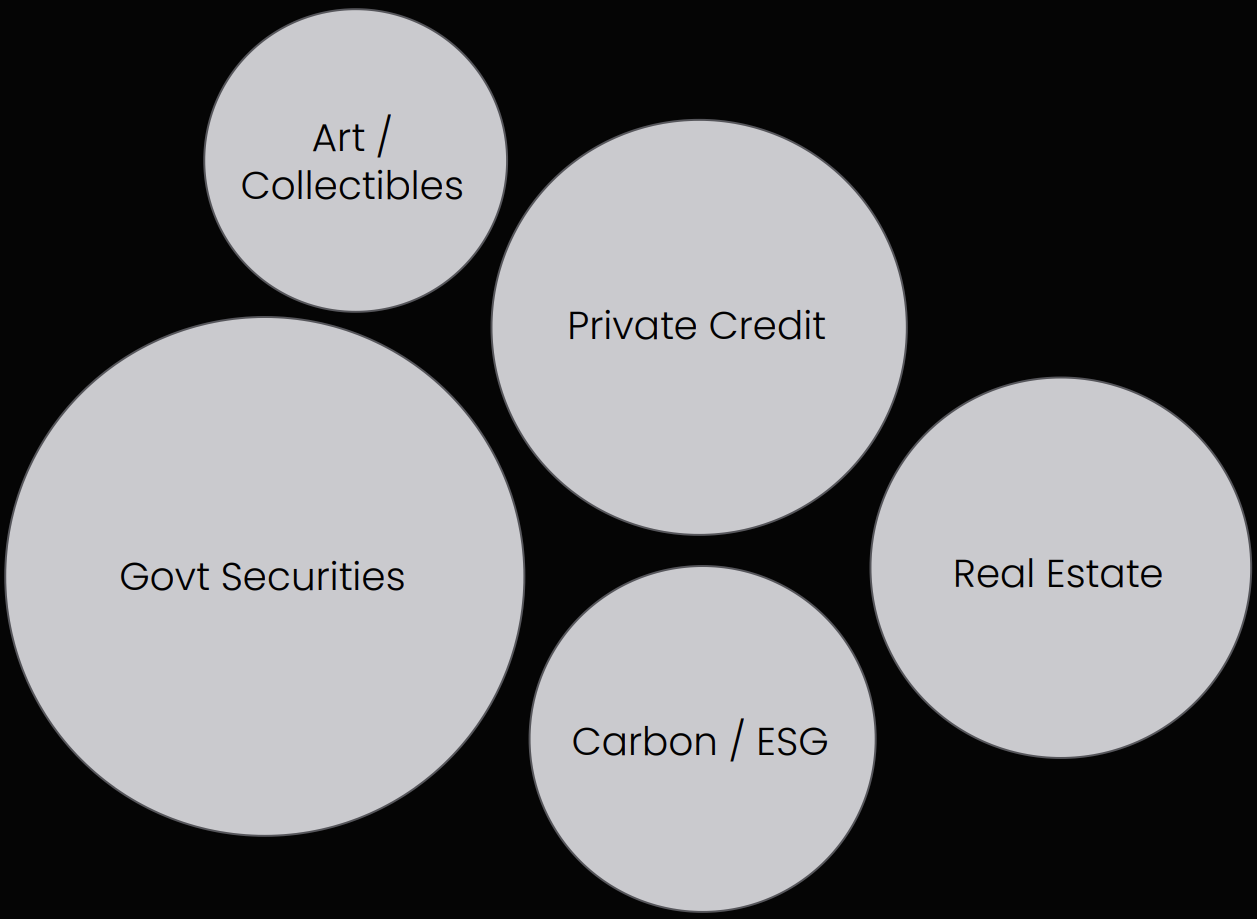

2025 Tokenised Asset Market Caps by Sector

| Asset Class | 2025 Market Cap | Key Driver |

|---|---|---|

| Govt. Securities | $20B+ | Institutional demand |

| Real Estate | $6B+ | Global fractionalisation |

| Private Credit | $13B+ | Fintech platforms |

| Carbon Credits/ESG | $2B+ | Sustainability focus |

| Art/Collectibles | $1B+ | Accessible investing |

How Tokenisation Works

Tokenisation fundamentally transforms how physical and intangible assets are represented and managed in the digital economy. By converting ownership rights into digital tokens recorded on a blockchain, opening up broader access to investment, simplifying trading processes, and redefining ownership structures.

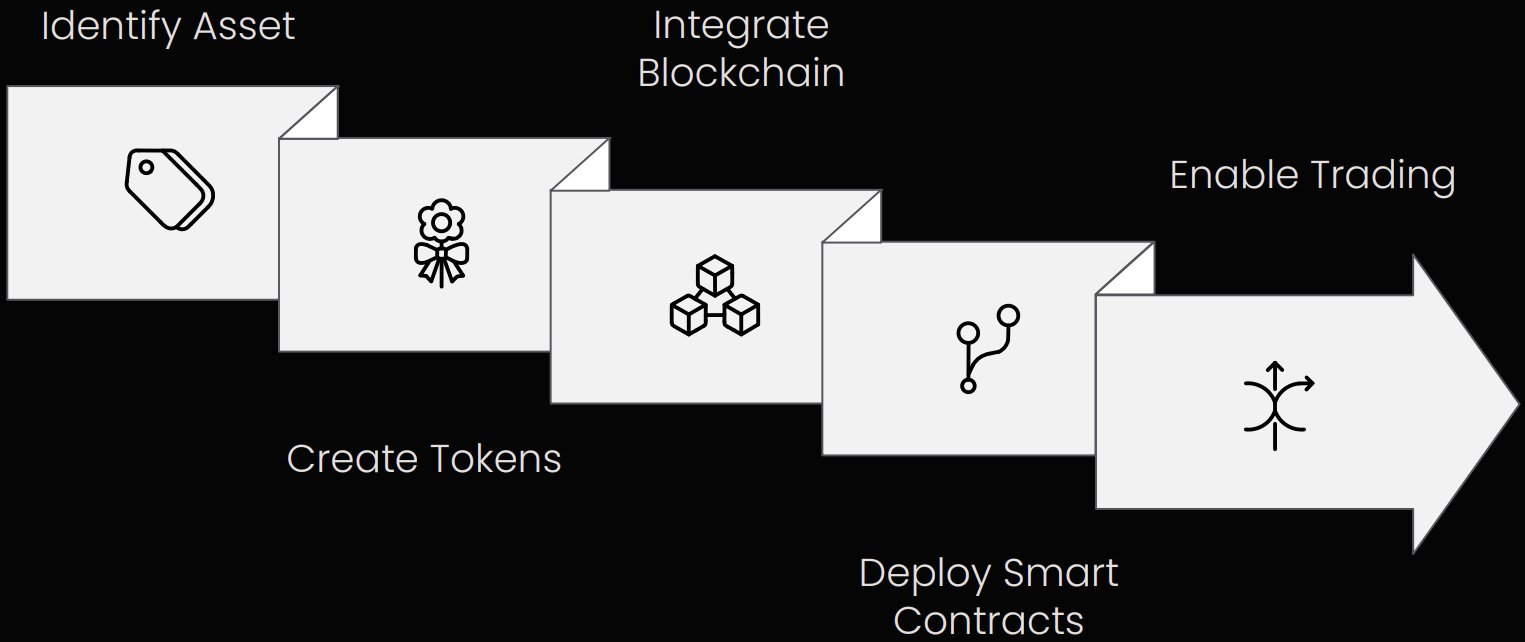

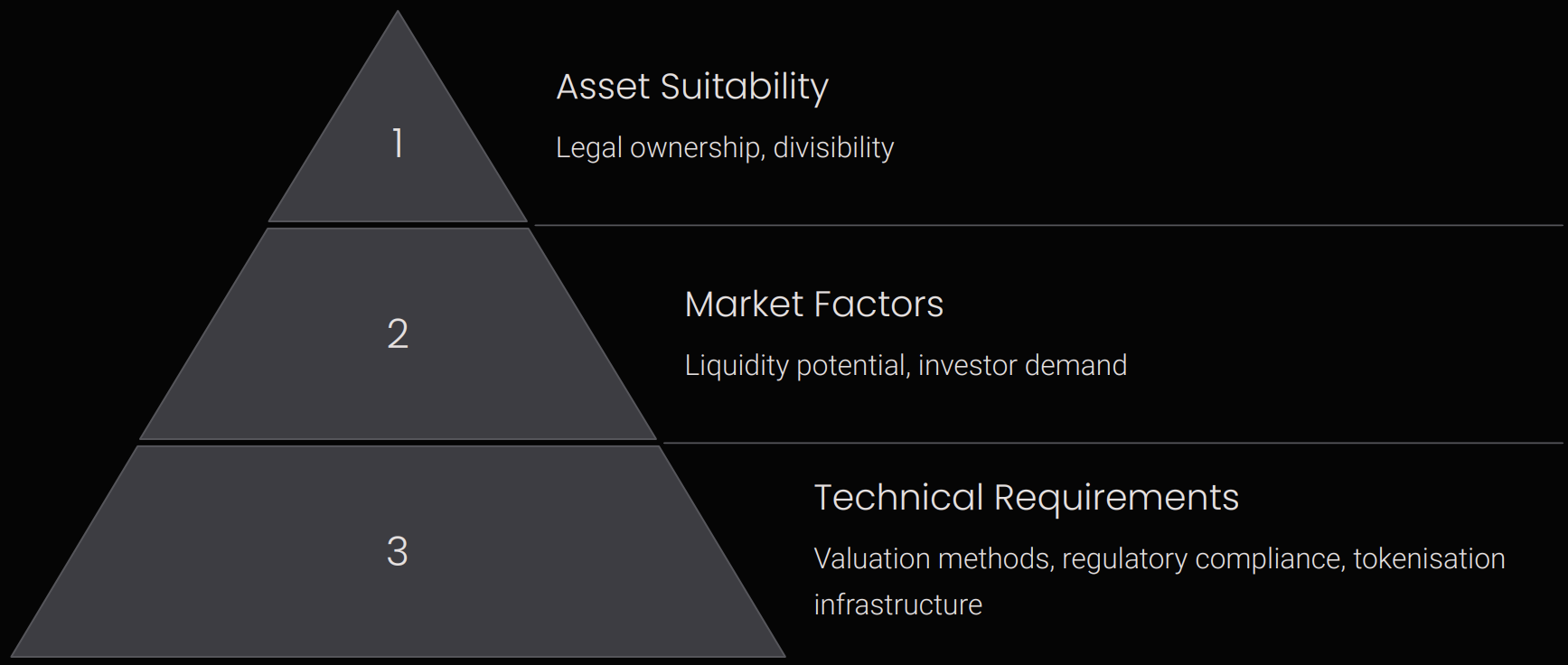

Tokenisation involves several key steps:

1. Asset Identification

The first step in tokenisation is identifying the asset to be tokenised. This could range from real estate, art, and commodities to financial instruments like stocks and bonds.

Real Estate

Properties, commercial buildings, and land parcels that can be divided into fractional ownership units.

Art & Collectibles

High-value artworks, rare collectibles, and unique items suitable for shared ownership.

Commodities

Precious metals, agricultural products, and other physical goods that can be digitally represented.

Financial Instruments

Stocks, bonds, securities, and other investment vehicles ready for blockchain-based trading.

2. Creating Digital Tokens

The ownership rights of the asset are converted into digital tokens, each representing a fraction of the asset. These tokens enable fractional ownership, meaning multiple investors can own a share of the asset. During this step, two key elements are addressed:

Token Standards

The appropriate token standard is chosen based on the asset type and intended use. For example, ERC-20 is commonly used for fungible tokens (e.g., cryptocurrencies or shares), while ERC-721 and ERC-1155 are popular standards for non-fungible tokens (e.g., unique art pieces or collectibles).

Token Minting

Once the standards are defined, the tokens are “minted,” which means they are created and deployed on a blockchain platform. This step finalises the digital representation of the asset and makes it ready for use in transactions.

Two Main Types of Tokens

Fungible Tokens

These are interchangeable tokens that represent a specific quantity of an asset, like cryptocurrencies (e.g., Bitcoin or Ethereum), where each unit is identical and can be exchanged for another unit without losing value. Fungible tokens are commonly used for divisible assets like shares in a company or currency.

Non-Fungible Tokens (NFTs)

Unlike fungible tokens, NFTs are unique and cannot be exchanged on a one-to-one basis. Each NFT represents a one-of-a-kind asset, such as artwork, collectibles, or real estate. Their uniqueness is often ensured through metadata stored on the blockchain, distinguishing each token from the others.

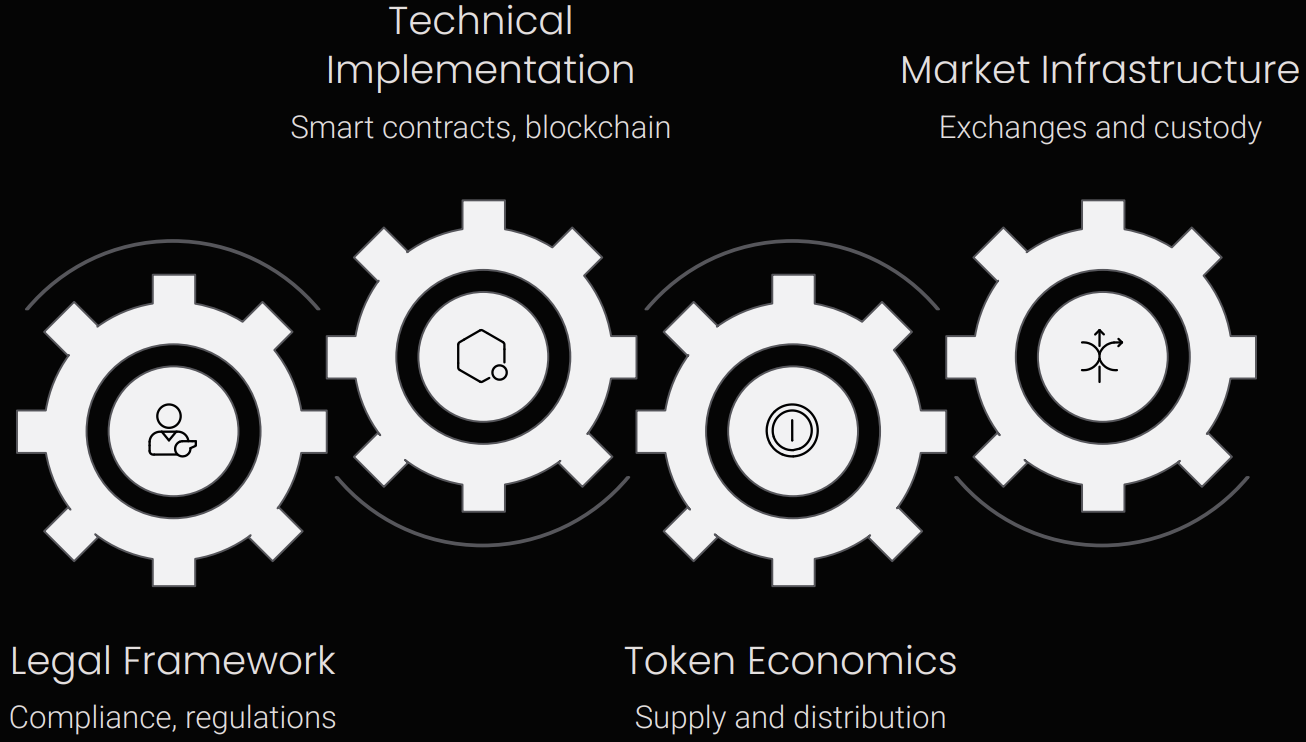

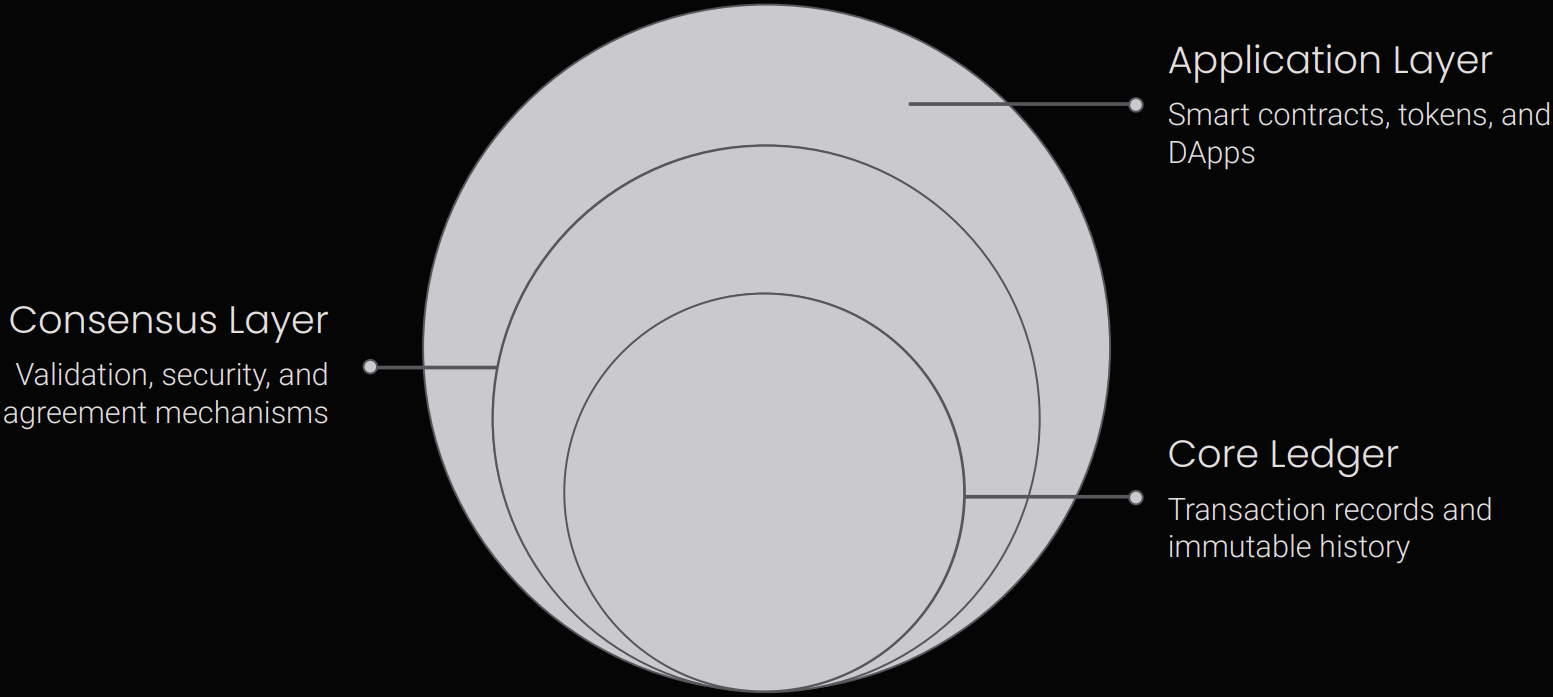

3. Blockchain Integration

Once the tokens are created, they are recorded on a blockchain, which acts as a secure and transparent ledger for all transactions. Blockchain technology provides several key features that are essential for tokenisation:

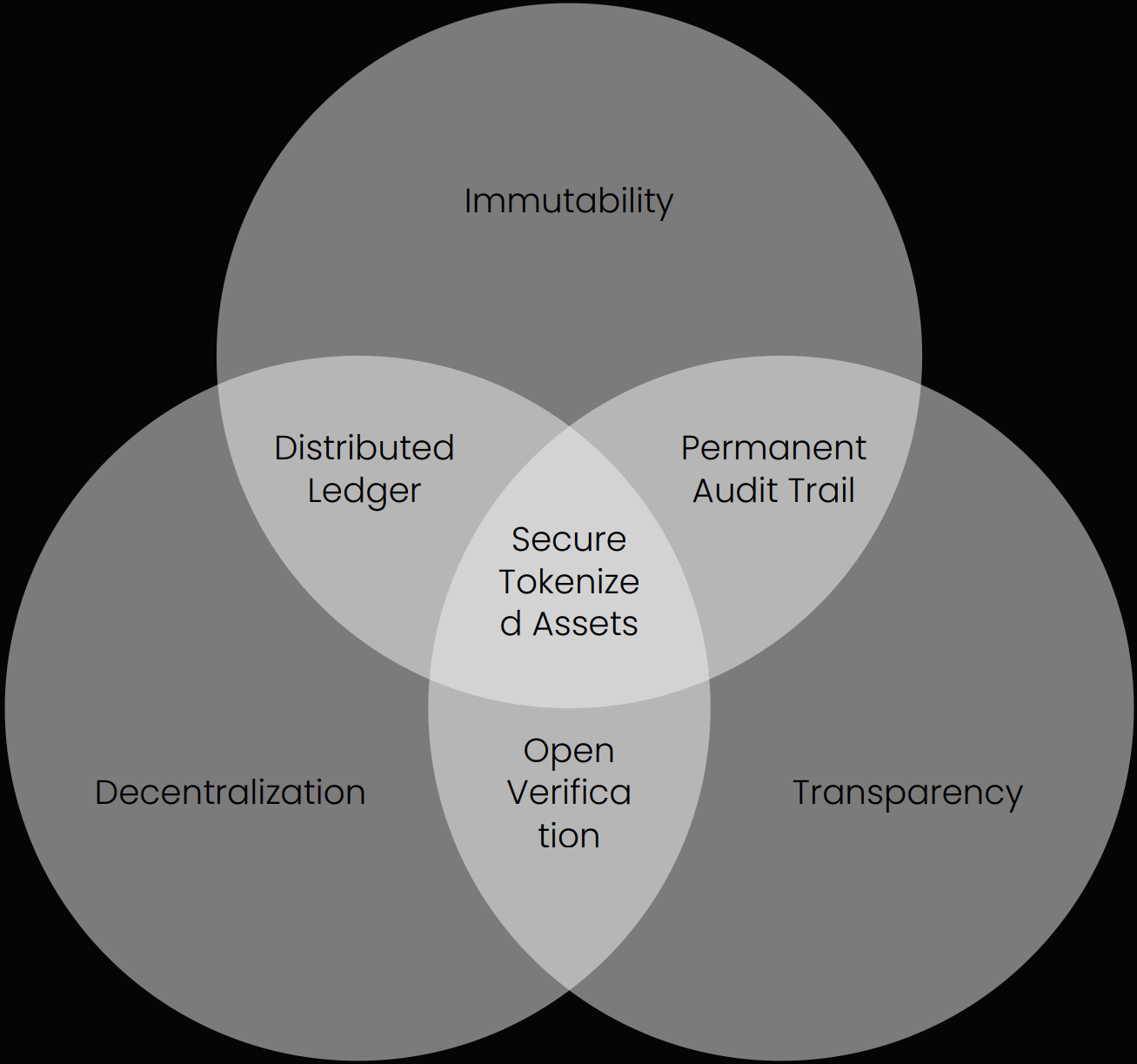

Decentralisation

Unlike traditional systems that rely on central authorities, blockchain operates on a decentralised network where multiple participants maintain copies of the ledger. This reduces the risk of fraud and ensures no single entity controls the data.

Immutability

Once recorded on the blockchain, transactions cannot be altered or deleted. This immutability guarantees that ownership records are permanent and verifiable.

Transparency

Blockchain allows all participants to view transaction histories, enhancing trust among users and ensuring accountability.

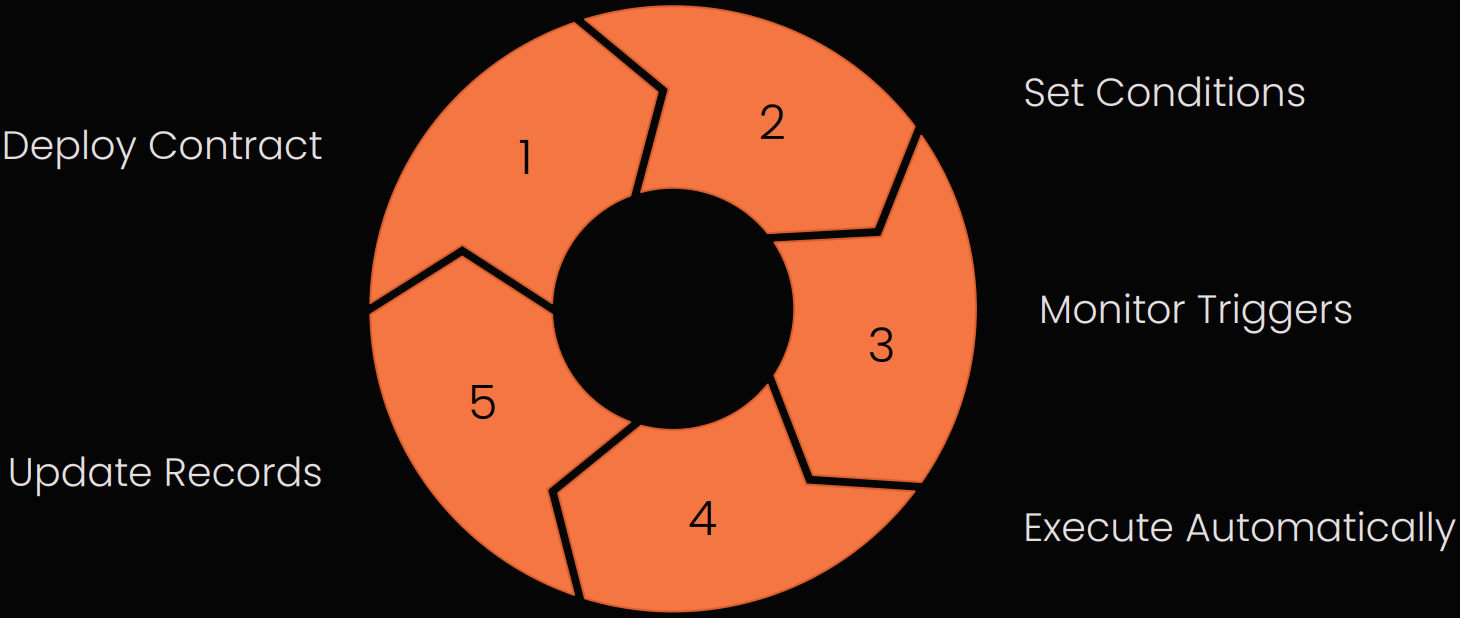

4. Smart Contracts

Smart contracts play a crucial role in automating the processes involved in tokenisation. These self-executing contracts have terms directly written into code and are used to manage ownership transfers and enforce compliance with predefined rules.

The Benefits of Smart Contracts

Automated Execution

Smart contracts automatically execute transactions when conditions are met. For example, if a buyer purchases a tokenised asset, the smart contract can automatically transfer ownership once payment is confirmed.

Compliance and Governance

Smart contracts can embed rules regarding ownership transfer and legal requirements directly into the code, reducing the need for intermediaries and ensuring compliance.

Complex Conditions

Smart contracts can also handle complex conditions for ownership transfer, such as escrow arrangements, where funds are held until both parties meet their obligations.

5. Trading and Liquidity

Once tokenised, assets can be traded on blockchain platforms, increasing liquidity and accessibility for investors. Tokenisation allows for 24/7 trading, unlike traditional markets that operate during limited hours. This greater liquidity enables faster transactions and broader access to global markets, making it easier for small investors to participate in high-value assets.

24/7

Continuous market access without geographical or time zone limitations

10x

Near-instant transactions compared to traditional systems taking days or weeks

100%

Investors worldwide can participate in previously restricted asset markets

Token Standards

Token standards are the rules that govern how digital tokens are created, issued, and managed on blockchain networks. These standards ensure that tokens work smoothly across various platforms and applications, providing consistency and security. While most token standards were initially developed for Ethereum, many have been adopted and adapted by other blockchains:

ERC‑20

Fungible Tokens (currencies, utility tokens)

ERC‑721

NFTs (unique digital assets)

ERC‑777

Enhanced Fungible (advanced features)

ERC‑1155

Multi‑Token (fungible + NFT in one contract)

Other Standards

Cross‑chain tokens (BEP‑20, TRC‑10/20, SPL)

1. ERC‑20: The Standard for Fungible Tokens

ERC‑20 is the most widely used standard for creating fungible tokens on the Ethereum blockchain. Fungible tokens are identical and interchangeable, each token is equal in value and functionality to another. This standard is highly interoperable, allowing tokens to work smoothly across various platforms and applications, providing consistency and security. It also comes with built‑in functions, such as transfer and approve, which simplify token transfers and management. ERC‑20 tokens are commonly used for utility tokens, Initial Coin Offerings, and cryptocurrencies like USDT.

Interoperability

Works seamlessly across various wallets, exchanges, and decentralized applications.

Built‑in Functions

Includes transfer and approve functions that simplify token management.

Common Uses

Utility tokens, Initial Coin Offerings, and cryptocurrencies like USDT.

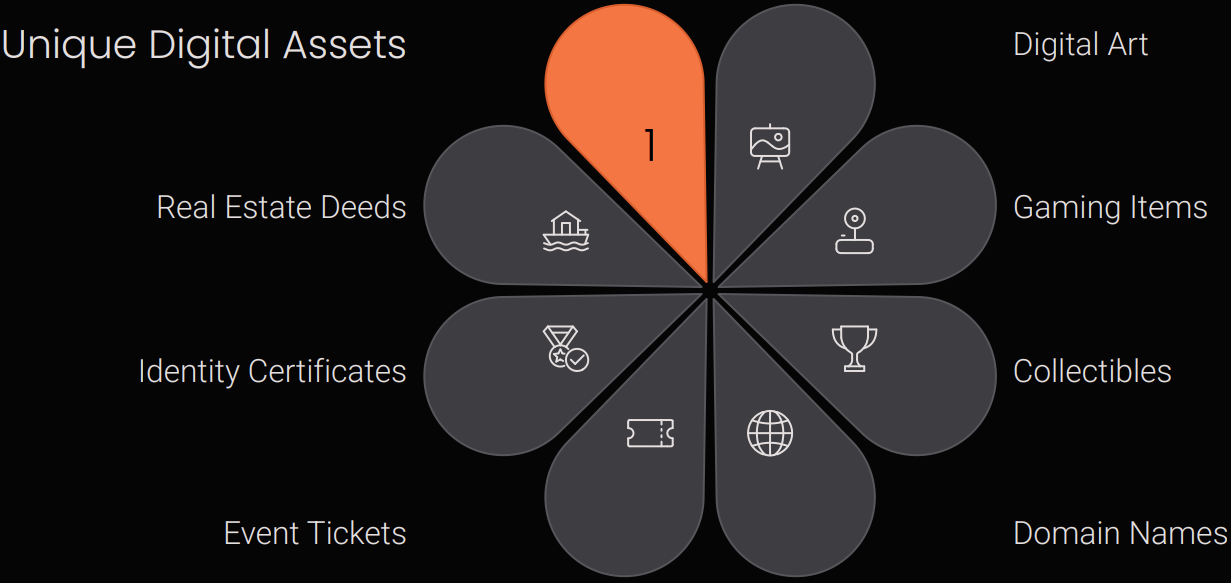

2. ERC-721: The Standard for NFTs

ERC-721 is the go-to standard for NFTs. Unlike fungible tokens, NFTs are unique and represent ownership of specific assets. Each token has a unique identifier that distinguishes it from others, making it ideal for one-of-a-kind assets like digital art or collectibles. Additionally, it supports metadata storage, allowing for the inclusion of extra details such as descriptions or images. This makes ERC-721 perfect for applications in digital art, gaming, and collectibles platforms like OpenSea.

Key Features

- Each token has a unique identifier

- Supports metadata storage for descriptions and images

- Ideal for one-of-a-kind digital assets

- Non-interchangeable by design

Primary Applications

- Digital art and collectibles

- Gaming items and characters

- Virtual real estate

- Platforms like OpenSea and Rarible

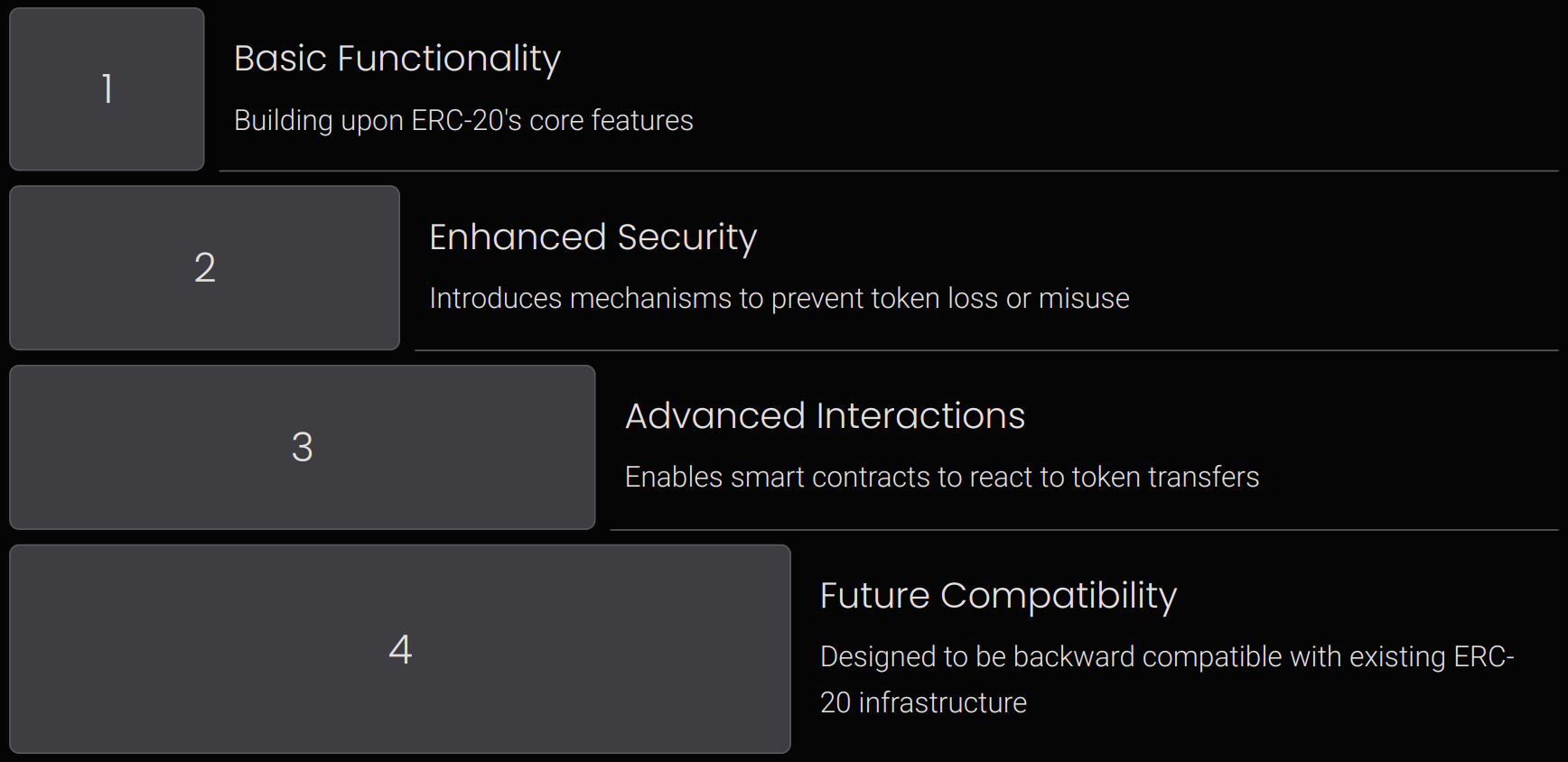

3. ERC-777: Enhanced Fungible Tokens

ERC-777 is an upgrade to ERC-20, offering more advanced features while maintaining compatibility with the earlier standard. It introduces a “hooks” system that allows smart contracts to respond to token transfers, enabling more complex interactions. This standard also enhances security by preventing tokens from being sent to restricted or invalid addresses. Projects requiring sophisticated token functionalities, such as automated financial tools or decentralised applications, often adopt ERC-777.

Hooks System

Allows smart contracts to respond automatically to token transfers for complex interactions.

Enhanced Security

Prevents tokens from being sent to restricted or invalid addresses.

Backward Compatible

Maintains compatibility with ERC-20 while offering advanced features.

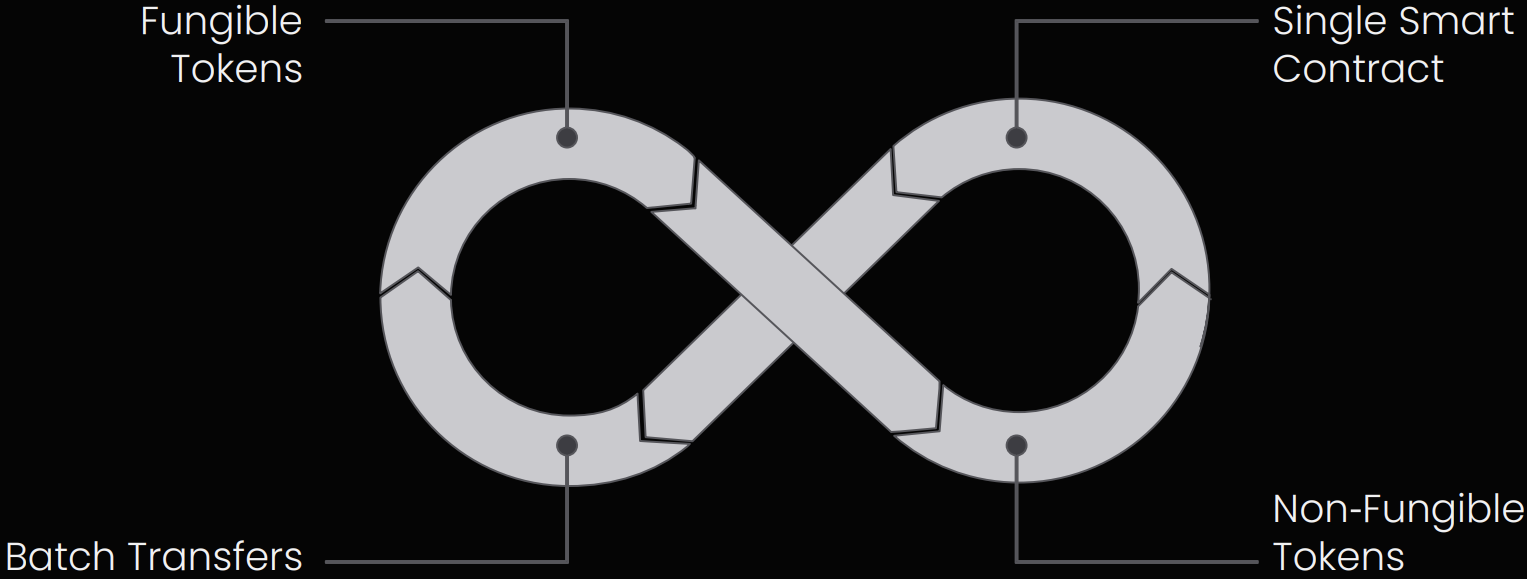

4. ERC-1155: The Multi-Token Standard

ERC-1155 allows for creating both fungible and non-fungible tokens within a single smart contract. This standard is highly efficient, as it supports batch transfers, enabling multiple tokens to be sent in a single transaction and significantly reducing costs. Additionally, it consolidates the management of various token types into a single contract, eliminating the need for separate contracts for each token. This makes ERC-1155 particularly useful in gaming applications where both in-game currencies (fungible) and unique items (non-fungible) need to be managed.

Why ERC-1155 Stands Out

1. Multi-Token Support

Create both fungible and non-fungible tokens within a single smart contract.

2. Batch Transfers

Send multiple tokens in a single transaction, significantly reducing gas costs.

3. Consolidated Management

Eliminate the need for separate contracts for each token type.

4. Gaming Applications

Perfect for managing both in-game currencies and unique collectible items.

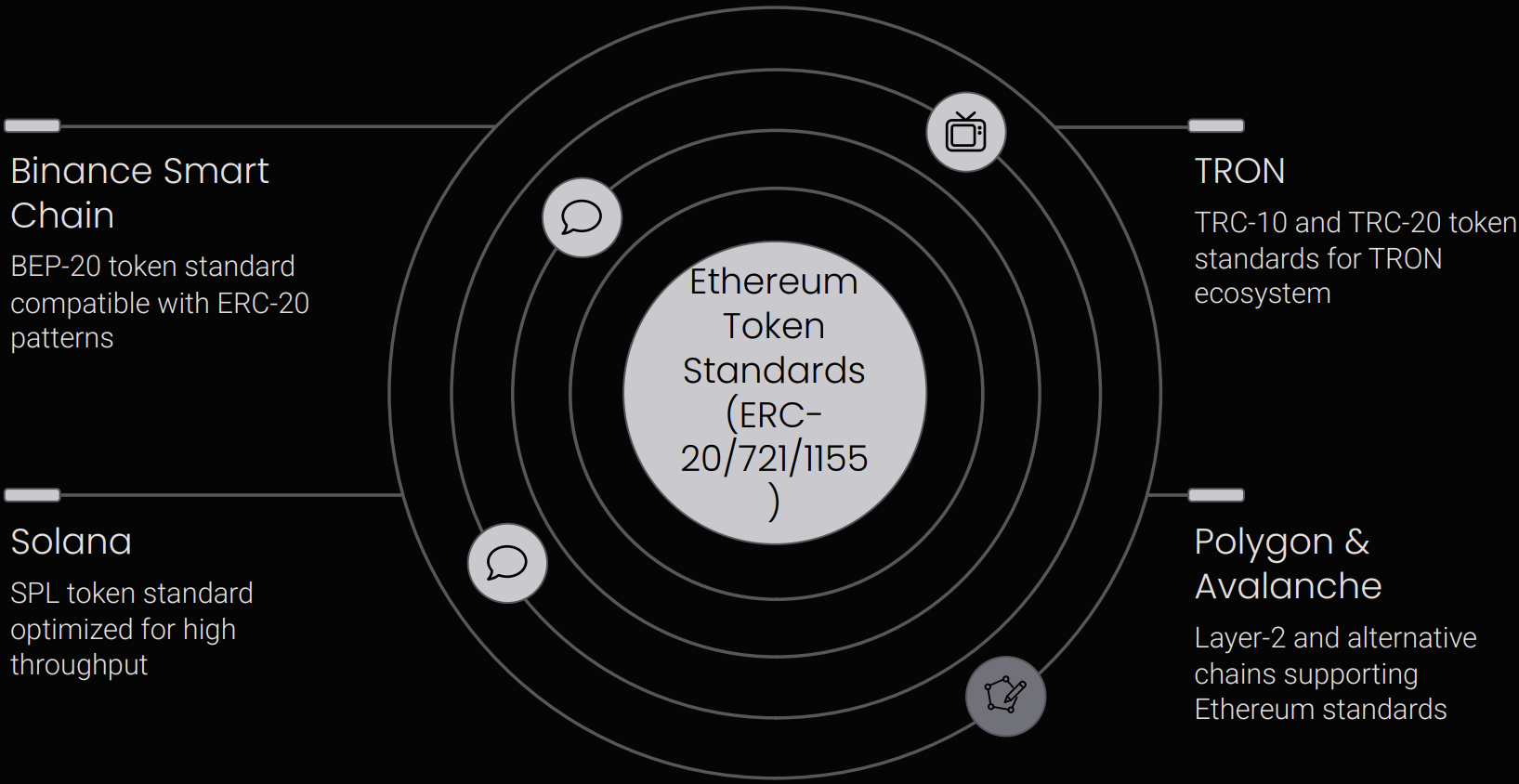

5. Other Blockchain Standards

While Ethereum dominates token standards, other blockchains have developed their own frameworks. BEP-20 on Binance Smart Chain mirrors ERC-20 but is tailored for Binance’s ecosystem, allowing seamless integration within its DeFi network. On the TRON network, TRC-10 provides a simpler option without requiring smart contracts, while TRC-20 offers more advanced functionalities similar to ERC-20. Solana’s SPL tokens focus on high-speed, low-cost transactions, making them ideal for high-performance decentralised applications.

History and Types of Crypto Tokens in Blockchain Ecosystem

The history of crypto tokens began in 2013 with the launch of Mastercoin by J.R. Willett, marking the first Initial Coin Offering (ICO). Mastercoin introduced the idea of creating new tokens on top of Bitcoin’s network. From 2013 to 2016, the development of crypto tokens grew steadily, but it wasn’t until 2017 that the ICO market exploded, attracting massive investor interest. This rapid growth also led to scams and increased regulatory attention. By 2018, the ICO bubble burst, pushing the industry toward safer and more regulated fundraising methods. Since then, crypto tokens have evolved beyond fundraising and are now driving innovation across various industries.

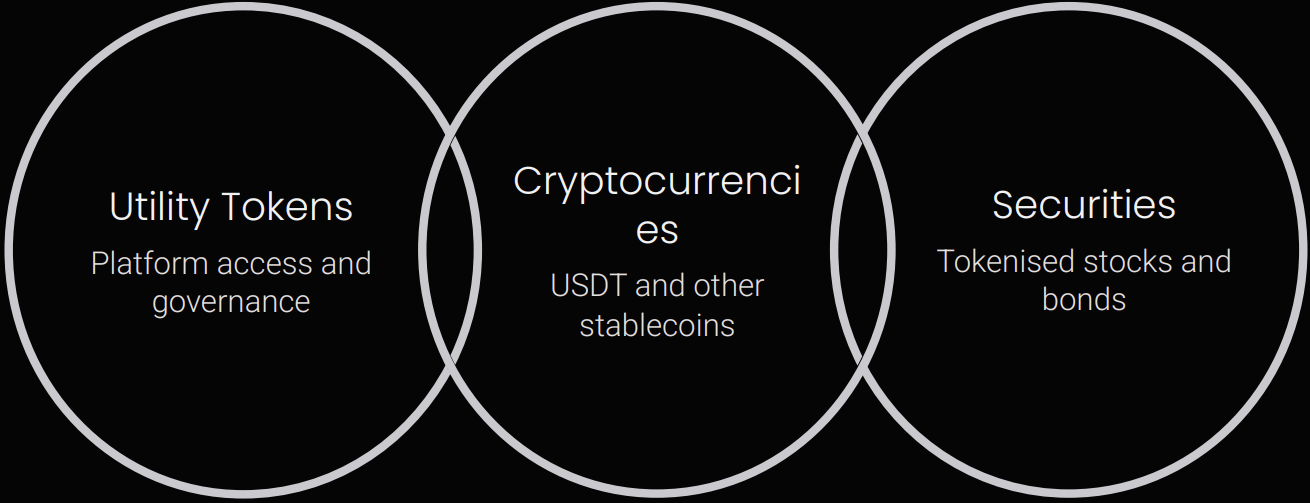

Types of Crypto Tokens

A crypto token is a digital asset created within a blockchain environment, typically operating on existing blockchain platforms like Ethereum. Unlike cryptocurrencies such as Bitcoin or Ethereum, which have their own blockchains, tokens are often built on top of established networks. Crypto tokens serve diverse purposes and can represent ownership, grant access to services, or facilitate decision-making, depending on their design.

Security Tokens

Security tokens are digital representations of ownership in assets classified as securities under applicable laws. They are subject to strict regulatory oversight, ensuring compliance with requirements such as registration, disclosures, and investor protections. Security tokens allow fractional ownership and often provide rights similar to traditional securities, including dividends and voting rights.

Utility Tokens

Utility tokens provide access to specific products or services within a blockchain platform. They are commonly used for platform interactions like paying transaction fees, unlocking premium features, or participating in governance decisions.

Other Notable Token Types

Stablecoins maintain a stable value by being pegged to fiat currencies or other assets. NFTs represent ownership of unique digital items. Governance tokens give holders voting rights in decentralised ecosystems or platforms.

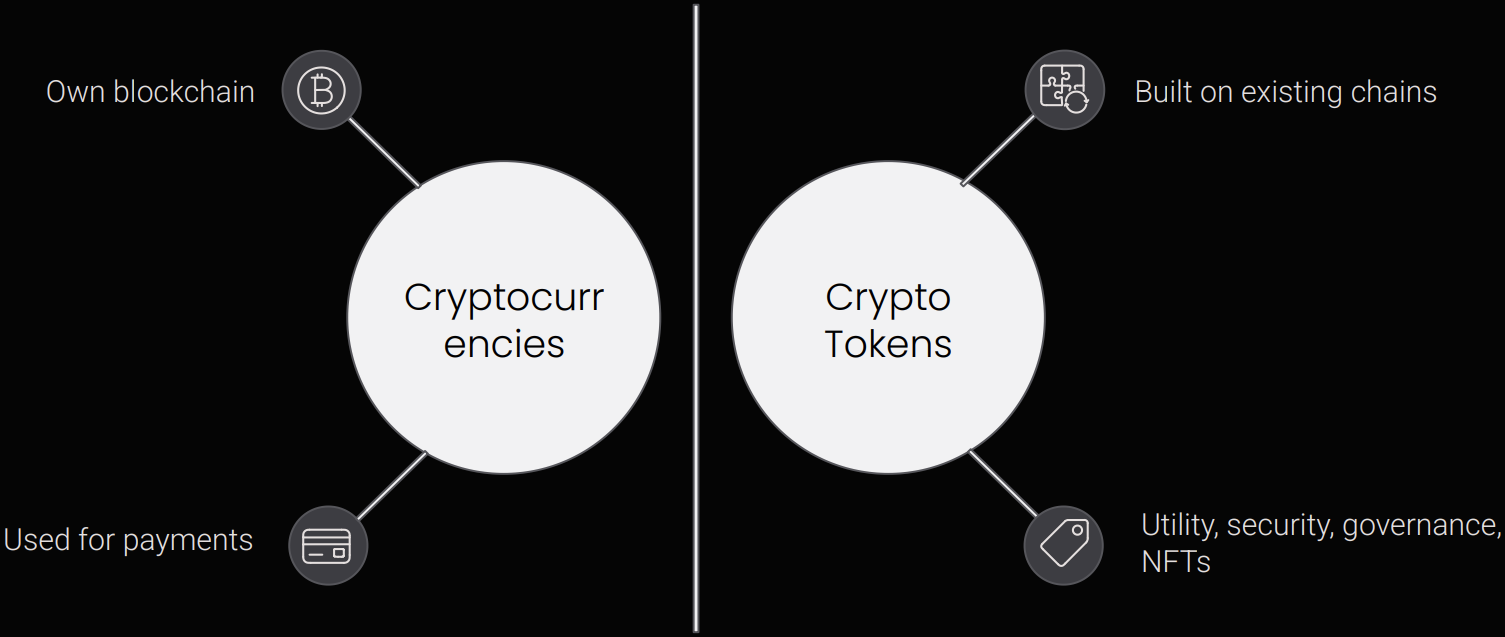

Cryptocurrencies vs. Crypto Tokens: Key Differences

Cryptocurrencies operate on their own blockchains and are used mainly for transactions and digital payments. Crypto tokens, however, are built on existing blockchains and can represent assets, ownership, or provide access to certain services. While tokens can be created and traded, they aren’t official currencies and are primarily treated as investment assets.

In summary, cryptocurrencies function as digital money with their own blockchain networks, while crypto tokens are versatile digital assets built on existing chains with a wide range of applications.

End Note

Tokenisation has moved from being a niche technical idea to becoming a practical part of today’s financial system. In simple terms, it means representing ownership of real-world assets as digital tokens on a blockchain. This makes it easier to transfer, verify, and divide ownership of assets such as real estate, private credit, government bonds, carbon credits, and intellectual property.

The growing interest from institutions and better technical infrastructure has helped tokenisation grow. At the same time, there are still important challenges to address, such as clear regulation, ensuring different systems work together, and increasing general understanding among investors.

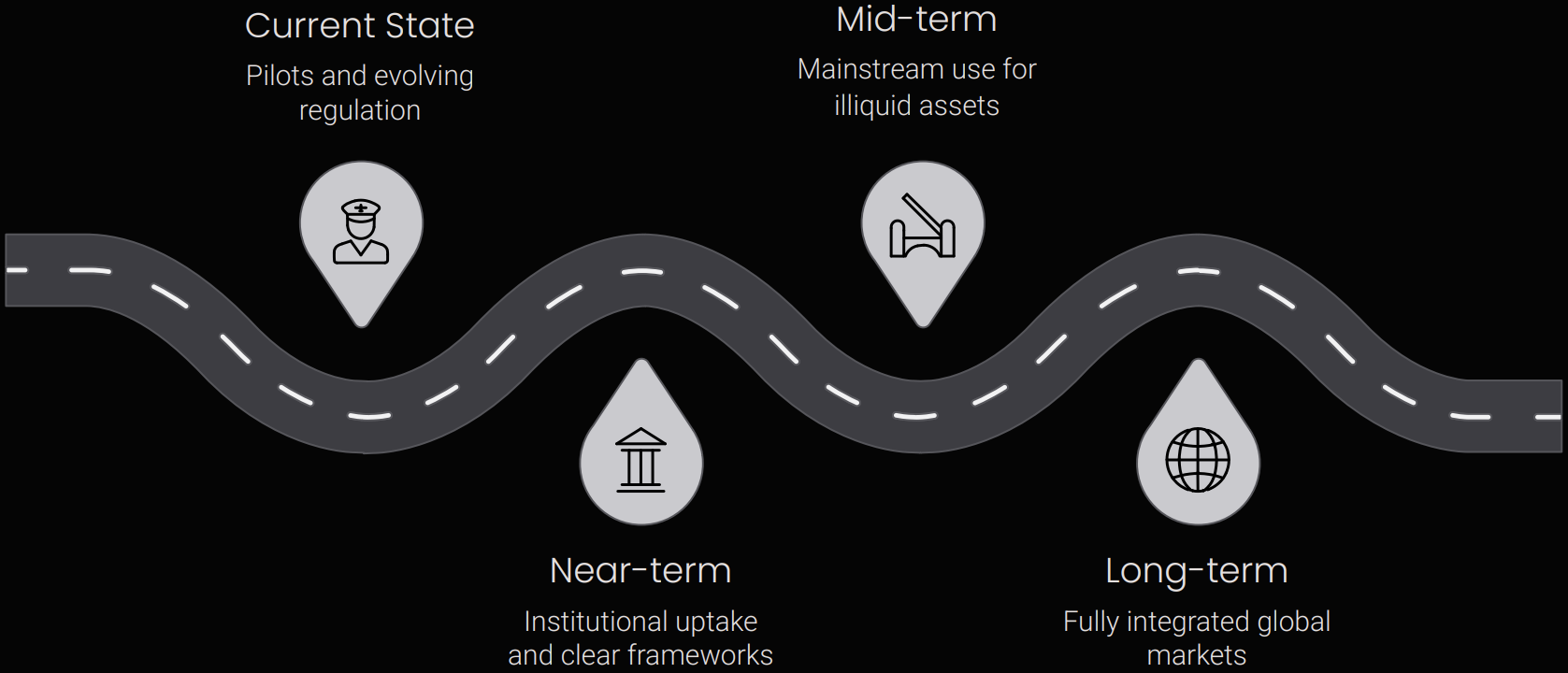

Looking ahead, tokenisation is poised to unlock unprecedented value across various sectors. Predictions suggest a substantial portion of global assets, potentially reaching tens of trillions of dollars by 2030, could be tokenised. We anticipate a phased evolution: the near-term (1–3 years) will focus on regulatory clarity and institutional pilots; the mid-term (3–7 years) will see mainstream adoption for illiquid assets like real estate and private equity; and the long-term (7–10+ years) will feature fully integrated tokenised markets for all asset classes, fostering global, real-time trading and settlement.

Even with these challenges, tokenisation is now seen as a real and useful shift in how financial markets can work. It allows fractional ownership, increases transparency, and speeds up settlement. It also opens access to assets that were previously limited to a small group of investors.

Next Steps for Key Stakeholders:

- For Investors: Explore tokenised investment opportunities with extensive regulatory frameworks. Focus on understanding the underlying assets and the platforms facilitating tokenisation. Diversify portfolios to include tokenised assets for enhanced liquidity and fractional ownership benefits.

- For Financial Institutions: Initiate pilot programs for tokenised securities and real-world assets. Invest in blockchain infrastructure and digital asset expertise. Collaborate with fintech innovators and regulators to shape market standards and integrate tokenised assets into existing financial systems.

- For Regulators: Develop comprehensive and harmonised legal frameworks that balance innovation with investor protection. Focus on cross-border cooperation to ensure consistency and prevent regulatory arbitrage. Promote sandboxes and experimental licenses to foster responsible development.

As regulators, industry players, and innovators continue to work toward common standards, tokenisation is likely to become a core part of global financial markets in the coming years. This transformation will not only create new investment opportunities but also fundamentally reshape market structures, driving greater efficiency, transparency, and financial inclusion worldwide.

The future of asset ownership is digital, fractional, and accessible to all.

Under Singapore’s regulatory framework, the Monetary Authority of Singapore (MAS) defines and classifies stablecoins through a layered structure primarily under the Payment Services Act 2019 (PSA), complemented by the Stablecoin Regulatory Framework finalised on August 15, 2023.

In general, stablecoins fall under the category of Digital Payment Tokens (DPTs) as per the PSA. A DPT refers to any digital representation of value that can be transferred, stored, or traded electronically and is commonly used as a medium of exchange. Entities dealing in DPT-related services, such as issuing, exchanging, or managing stablecoins, must obtain a Major Payment Institution (MPI) or Standard Payment Institution (SPI) license. The PSA focuses on compliance with anti-money laundering (AML), counter-terrorism financing (CFT) obligations, and technology risk management. Fiat-referenced stablecoins are therefore primarily regulated for their function as a payment medium.

MAS introduced a heightened category known as Single-Currency Stablecoins (SCS) under its 2023 framework. These stablecoins are subject to enhanced prudential, reserve, and redemption requirements if they meet specific criteria. The framework distinguishes between general DPTs and MAS-regulated stablecoins, as shown below:

| Category | Definition and Criteria | Regulatory Status |

| SCS | Stablecoins pegged to a single fiat currency. | Subject to the general DPT regime unless they meet the specific requirements. |

| MAS-Regulated Stablecoins | SCS pegged only to the Singapore Dollar (SGD) or any G10 currency. | Issuers must meet strict requirements on reserve backing, segregation, redemption at par, and capital adequacy. Only compliant issuers can use the term “MAS-regulated stablecoin.” |

Issuers of MAS-regulated SCS engage in a regulated activity known as the “Stablecoin Issuance Service” under the PSA. Those whose total issuance exceeds S$5 million are generally required to hold an MPI license. Stablecoins that do not qualify as MAS-regulated SCS remain under the standard DPT regime. These include:

- Multi-currency stablecoins pegged to multiple fiat currencies;

- Non-G10 fiat-referenced stablecoins;

- Algorithmic stablecoins, which rely on supply-adjusting algorithms and are considered more volatile; and

- Asset-referenced stablecoins, backed by non-fiat assets such as gold or commodities.

Certain stablecoins may also fall under other legal categories. For instance, if a stablecoin’s structure gives it characteristics of an investment product, it could be subject to the Securities and Futures Act (SFA), which governs securities, collective investment schemes (CIS), and derivatives. In such cases, related activities would require SFA licensing. Stablecoins generally do not qualify as e-money under the PSA, as they are not “pegged” by the issuer in the same way and often lack a direct claim against the issuer.